Bank of England slashes its growth forecast (again)

However, two members of the committee – Ian McCafferty and Michael Saunders – voted to raise borrowing costs and the Bank signalled that investors should prepare themselves for more interest rate increases than they now expect.

The Bank’s forecast downgrade for the United Kingdom economy came as it said reduced consumer spending will drag GDP growth to 1.7 per cent this year, down from a previous forecast of 1.9 per cent.

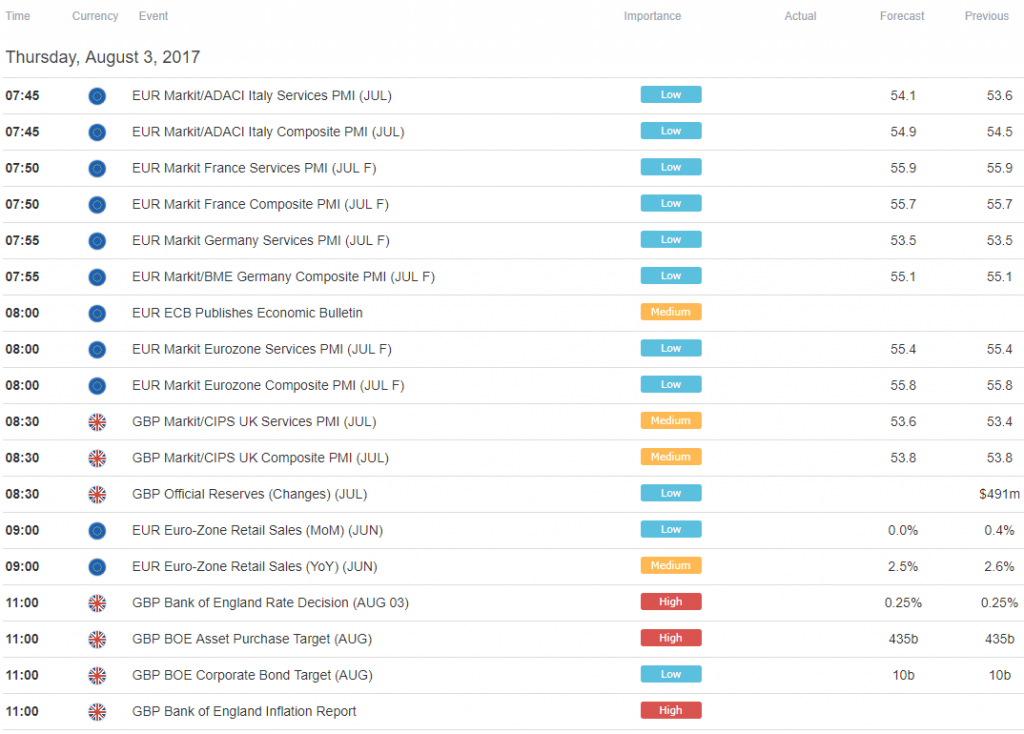

The Bank of England’s Monetary Policy Committee (MPC) has held the base rate at its current level of 0.25%.

The Bank of England (BOE) threw cold water on the red-hot Sterling on Thursday.

By 2pm BST, the pound was 0.78% lower against both the dollar and the euro, trading at $1.3118 and €1.1062, as the common currency moved towards its highest level against sterling since November past year.

Yields also dropped, with the interest rate on 2-year United Kingdom paper falling 4 basis points to 0.233%.

Prime Minister Theresa May has come under increasing pressure from lawmakers to end a below-inflation one per cent cap on public sector pay rises that has been in place since 2013 as part of efforts to cut government spending. Bond yields declined from July highs but remained elevated, as some market participants believe that the BoE may surprise, with a 25-basis point rate hike. ING doesn’t expect tightening to start until 2018.

“The market took the decision as pretty dovish, probably because the 6-2 vote suggests the MPC is a little further away from hiking than it was last time when it voted 5-3”, said Neil Wilson, senior market analyst at ETX Capital, in a note.

In the previous MPC meeting three members had voted to raise interest rates, versus five who wanted no change.

This was followed by gross domestic product figures showing growth was limited to 0.3% in the second quarter in what the Office for National Statistics described as a “notable slowdown” for the economy. However, the 2018 earnings growth forecast was cut to 3% from 3.5% and 2019’s to 3.25% from 3.75%.

Currently, inflation is running at 2.6%, while wage growth is just above 2%, meaning that regular Brits are now bringing in less in wages than prices are growing, effectively lowering their real incomes.

The Committee made the decision to keep rates the same by six votes to two. This comes at a time when United Kingdom households are already seeing their purchasing power diminish as a result of the weakening sterling following last year’s vote to exit the European Union blog of nations. Instead it is likely that the BOE will target the sub-sector of borrowers and lenders most at risk, rather than choking off lending entirely and rocking the economic boat a la 2008.

“We have the Bank of England, the Treasury Department, the CBA all the working off the same model”.

So where does all this leave investors after the mixed messages from Threadneedle Street on Thursday?

“The market’s reaction was swift: the pound fell sharply and this helped to boost the FTSE 100”, he said.