Stocks notch up new high but it’s all about the Fed

Also, it is likely the Fed will announce it will start shrinking its balance sheet as soon as October.

In commodities, oil prices rose after Iraq’s oil minister said OPEC and other crude producers were considering extending or even deepening a supply cut to curb a global glut, while a report showed a smaller-than-expected increase in USA inventories.

In corporate news, Toshiba has swung back to favoring a consortium backed by Western Digital – a US data company also involved in a joint venture with the Japanese conglomerate – for the sale of its memory chip unit, Reuters reported.

BIG GAINERS: Industrials companies were among the biggest gainers.

Elevated risk appetite in Europe meanwhile saw the gap between Portuguese and Italian 10-year government bond yields narrow to levels not seen since the start of the eurozone debt crisis of 2010-2012.

Three stocks rose for every two that fell on the New York Stock Exchange. U.S. Bancorp added 85 cents, or 1.6 percent, to $53.23.

That prompted a sector rotation out of stocks like utilities – with the S&P utilities index down 0.8 percent – and into banks.

The dollar was 0.4 percent higher at 112.610 yen after brushing 112.725, its highest since July 18.

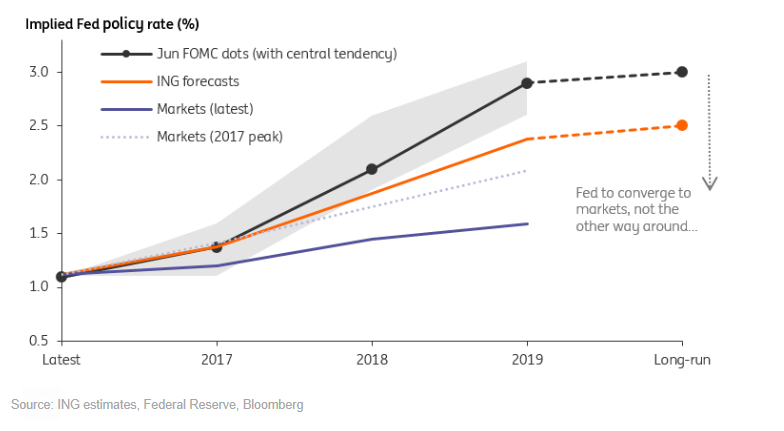

The Australian dollar was up around half a percent at $0.8047 after comments overnight from its central bank outlined the constructive growth conditions for its economy. Since December 2015, the Fed has modestly raised the rate four times.

During the 2008 financial crisis, Washington slashed the key interest rate almost to zero in a bid to boost growth and jobs. The Fed is seen as virtually certain to leave rates unchanged but is expected to begin the process of slowly unwinding the $4.5 trillion balance sheet accumulated via the bond-buying program that ended in 2014.

And by December the Fed may have a more dovish makeup, given that Vice Chair Stanley Fischer, a proponent of tightening, plans to step down next month.

Some analysts thought the Fed might would raise interest rates today because of Chairman Yellen’s press conference. “Early movers in the region have so far been seen with mixed movements, mostly in red”.

On Wall Street, the Dow had a record close for the fifth session in a row while the S&P set a closing record for the second consecutive session, led by gains in financial shares.

The Standard & Poor’s 500 index rose 3 points, or 0.1 percent, to 2,507 as of 3:34 p.m. The Russell 2000 index of smaller-company stocks was up 5 points, or 0.4 percent, to 1,446.

-The yen slid 0.5 percent to 112.16 per dollar. The euro strengthened to $1.1997 from $1.1953. Other energy futures also closed lower.

Amid an otherwise modest equity market response to the Fed’s latest policy announcement, the move up in bank stocks stood out and tracked closely a climb in yields on U.S. Treasury securities. In view of realized and expected labor market conditions and inflation, the Committee chose to maintain the target range for the federal funds rate at 1 to 1-1/4 percent.

Brent crude futures LCOc1 last stood at $56.17, down slightly from late USA levels as US benchmark West Texas Intermediate (WTI) CLc1 drifted down to $50.64.