Extremely Informative Stock: United States Steel Corporation (NYSE:X)

Advisor Group Inc.’s holdings in United States Steel were worth $394,000 as of its most recent filing with the Securities & Exchange Commission. Value of 33.00000. The Q.i.

There are multiple valuation ratios that Wall Street professionals consider when evaluating a stock, and compare to the ratio for the industry as a whole. If the ratio is greater than 1, then that means there has been an increase in price over the month. The objective of the Q.i. Typically, the lower the value, the more undervalued the company tends to be. CACI International Inc (CACI) has risen 32.11% since December 11, 2016 and is uptrending. Ticker has price to earnings growth of 2.67, which is a valuation metric for determining relative trade-off among price of a stock. The VC is displayed as a number between 1 and 100.

The company now has an insider ownership of 0.4 Percent and Institutional ownership of 66.6 Percent.

A number of research firms have recently weighed in on X. Axiom Securities raised United States Steel from a “sell” rating to a “hold” rating and cut their price target for the company from $41.83 to $18.55 in a report on Monday. AKS’s shares are therefore the less volatile of the two stocks. Many stock enthusiasts will also keep a sharp focus on positive estimate revisions to help gain an edge in the markets. (NASDAQ:ALIM). Weiss Multi invested in 84,000 shares or 0% of the stock.

According to analysts AK Steel Holding Corp (NYSE:AKS)’s minimum EPS for the current quarter is at $-0.2 and can go high up to $0.03. Following the acquisition, the director now directly owns 3,009 shares in the company, valued at approximately $75,706.44. This ranking uses four ratios. State Street Corp now owns 5,889,434 shares of the basic materials company’s stock worth $130,394,000 after acquiring an additional 341,591 shares during the period. When looking at the ERP5 ranking, it is generally considered the lower the value, the better. Looking further out we can see that the stock has moved -0.03% over the year to date.

The company’s stock is now moving with a -ve distance from the 200 day SMA of approximately -11.09%, and has a solid year to date (YTD) performance of -47.8% which means that the stock is constantly adding to its value from the previous fiscal year end price. Since analyst price targets calculations are subjective, there often can be wide range of targets from various analysts. The lower price P/S ratio indicates attractive the investment. The firm has fifty days moving average percentage of 4.88% to its latest price change.

AK Steel Holding Corp (NYSE:AKS)’s trailing twelve month revenues are $6 Billion, whereas its price to sales ratio for the same period is 0.28.

Annual Sales Growth in the past 5 years was -1.9 percent.

Keeping watch on technicals may involve many different plans and scenarios. This score indicates how profitable a company is relative to its total assets. United States Steel had a net margin of 1.05% and a return on equity of 10.27%. The low EPS estimate is $-0.2, while the high EPS estimate is $0.03. ROIC is a profitability ratio that measures the return that an investment generates for those providing capital. The ROA tells us exactly what earnings were generated from the invested capital. ROIC helps show how efficient a company is at turning capital into profits. The employed capital is calculated by subrating current liabilities from total assets. The ROIC Quality of United States Steel Corporation (NYSE:X) is 2.780981.

Looking into last 5 trades, the stock observed a return of nearly 8.87%.

The amount of free cash flow available to investors is ultimately what determines the value of a stock.

The TTM operating margin for the company stands at 4.1%. BlackRock Inc. lifted its holdings in shares of United States Steel by 0.4% during the 2nd quarter.

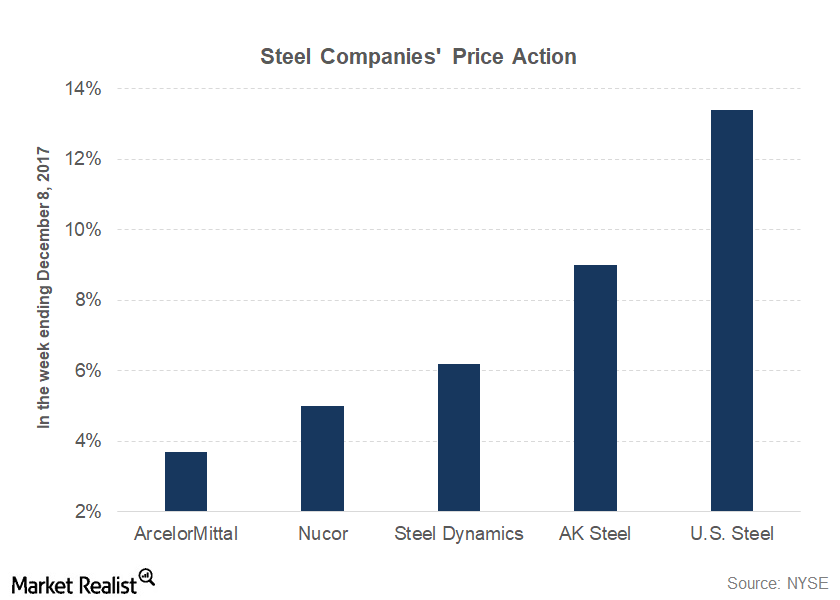

JP Morgan “Upgrades” AK Steel Holding Corp (NYSE:AKS) in a research note issued to investors on 12/07/17 to Overweight with price target of $0. The stock has “Outperform” rating by Robert W. Baird on Friday, October 9. The co’s performance for 6 months was reduced of -15.89%, 1-year performance stands at -46.69% and year to date showing reduced performance of -47.11%.