$22 trillion of money to rescue markets, but inflation threat is building

Strong prospects of the Fed hiking interest rates in the next month has led to a spike in United States bond yields, which touched 2.89%, highest level in almost four years.

At one point, the Dow fell 6.3 percent or 1,597 points, the biggest one-day points loss ever. Average hourly earnings increased by 2.9% in the year to January, up from an upwardly revised 2.7% growth in the previous month and the fastest rate of increase since June 2009.

Momentum is going to be a major concern for investors early in the week because of the presence of strong downside momentum at Friday’s close.

Take the Indian context.

He said there were wage pressures in some industries across the world but these were not widespread, and there was no sign of a let-up in deflationary forces unleashed by the rise of online retail, automation, digitization and globalization.

Attractive yields on a safer investment have made stocks suddenly less attractive.

The tricky thing about predicting a stampede out of bonds is that fixed income is, by definition, different from other asset classes.

Equity investments are deemed risky. Treasuries are the closest thing out there to a risk-free asset because there’s an assumption that the U.S. will never default on its obligations. Therefore, we do not need to offer such a big risk premium to come into NZ bonds. The bond market is the equivalent of the people betting directly on the race.

7-year -10 bps @ 2.665%. The bond yield/equity yield or BEER ratio at 1.85 makes equities look overvalued.

S. bond yield forecasts higher but was unable to disclose details due to regulatory factors.

What is making bond yields rise?

With this trend of mildly rising inflation, gold prices and T-bond yields will likely continue moving upward until there are signs of an economic slowdown and/or a bubble burst in stocks.

“This will be bad for bonds and mediocre for equities”.

“The cause of this correction is the ostensibly withdrawal of liquidity by central bankers, and consequently rising interest rates”.

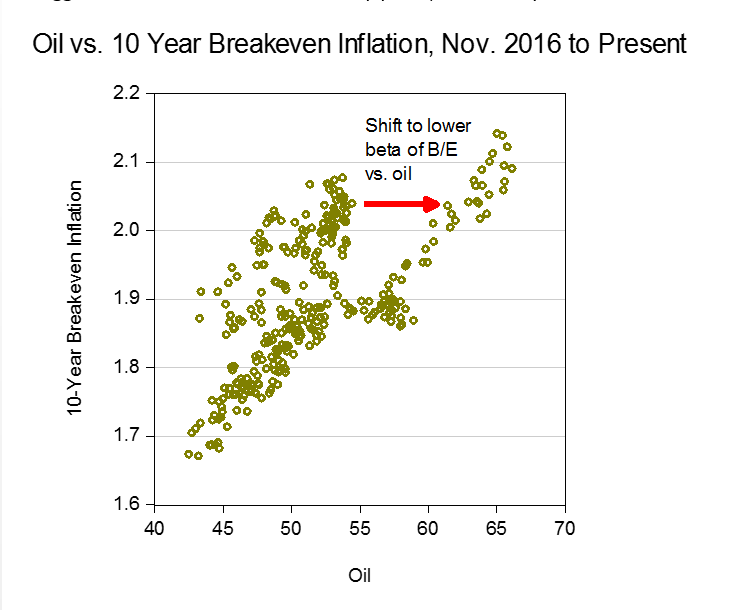

Robust economic data, a pick up in inflation expectations and hawkish central bank talk have prompted investors and analysts to reassess the outlook for bonds. European Central Bank too picked up even junk bonds from various countries.

“You are beginning to see the edge taken off the U.S. economy as capacity has disappeared”, Warner said.

All that said, while presidents can influence markets, they don’t control them.

It may be argued by some that the growth of our KiwiSaver funds and the NZ Super Fund has meant that we are less dependent upon foreign savings as we have more of our own to invest. In economics, that’s called inflation. A stronger economy generally strokes inflation.

Investors are afraid that the recent rise in US wages means inflation is on the way. For a $10,000 bill, the three-month price was $9,962.08 while a six-month bill sold for $9,916.58.

When the Fed raises rates, the cost of borrowing money increases. It is preparing markets for two-to-three rate hikes, so that it can actually deliver one or two.

When interest rates rise sharply, stocks often fall.

“It is hard to see the 10 year US Treasury breaking much above 3 to 3 ¼% without a sustained increase in inflation, which would raise expectations of more aggressive central bank tightening”.

Fears of contagion risk have subsequently spread to equity markets with the S&P 500 suffering its worst weekly performance in two years last week, falling 3.9%, while the Dow Jones lost 4.1%. “It also helps reduce the amount of interest expense the USA government has to pay on (large and increasing) federal debt”.

So if you still think a 10 per cent long-term capital gains tax is what is hurting Dalal Street?