China hits US with tariffs on 128 products

President Donald Trump persists in using a phoney number to justify his market-shaking trade actions against China.

All the talk and hype can make it hard to understand what’s actually happening. His tirades are starting to spook the markets and to trigger retaliatory tariffs that can have a damaging economic impact.

First, let’s take a theoretical look at tariffs.

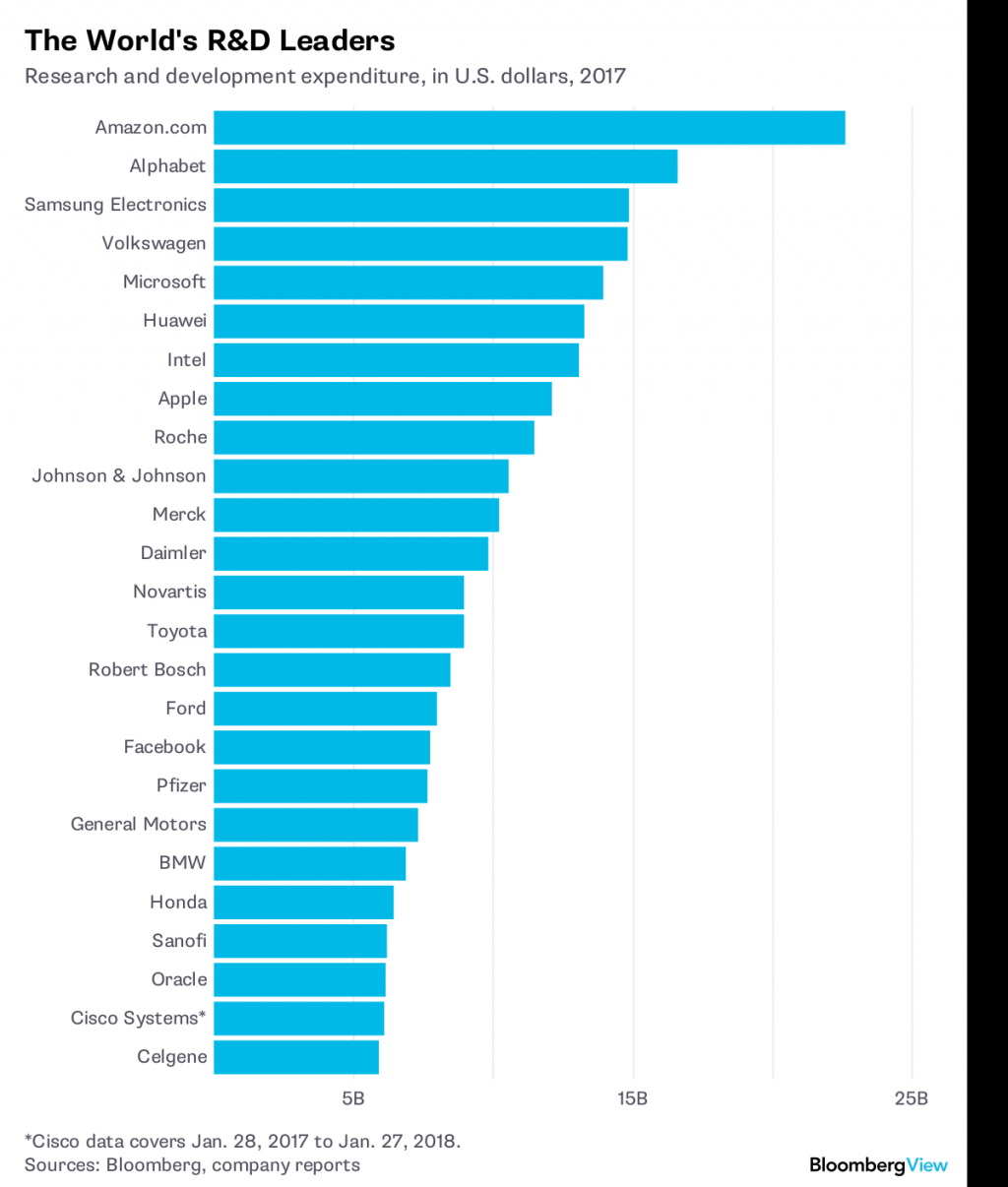

The newly-levied tariffs from the USA on China are tied to what the US claims has been the country’s unfair practices around intellectual property and forced technology transfer from US companies to Chinese entities in order to do business there.

Of the top 10 soybean-producing and exporting states, eight voted for Trump and only two for Clinton.

The American farmer is the best in the world.

Trump has criticised China for its large trade surplus with the United States, and has demanded a US$100 billion (NZ$137 billion) reduction in the trade imbalance, but the tariffs appear to instead target China’s innovation programme.

So why is everyone talking about tariffs?

Raoul Leering, head of worldwide trade analysis at Dutch bank ING, said President Trump’s Chinese trade gamble could pay off. These goods range from market-ready products, such as solar panels and washing machines, to manufacturing inputs such as steel and aluminum.

Chinese Vice Finance Minister Zhu Guangyao said at a news conference in Beijing that the period before the tariffs go into effect is the “time to negotiate and cooperate”. Canada’s soybean producers say China’s expanded list of tariffs applied on US products will cause global disruptions and uncertainty.

“Nobody’s rubbing their hands in glee over what might be somewhat lower prices on USA oversupply because the broader implications of trade wars for the world economy”. China announced plans to levy the tariffs Tuesday night.

In 2017, the United States had a trade deficit with China of over $375 billion – the highest on record.

US import duties on Chinese aluminum and steel were announced in March. The Dow Jones Industrial Average (INDEXDJX:.DJI) fell as low as 23,523.16, a 510.2-point drop from Tuesday’s close.

Beijing announced early Wednesday that it plans to impose levies on $50 billion worth of USA exports. They’ve been his family’s main crop for more than 150 years. If these goods are taxed, they’ll now pay more for these same items.

Eventually it will mean less money and fewer jobs. And more Americans will get hurt the further the brinkmanship goes, especially if the stock market sell-off ends one of the longest bull markets in USA history.

“Given the relatively large dependency of the Chinese economy on American demand, it is likely that China will, in the end, cut its losses and be willing to give Trump something”. It’s a snowball effect.

Greg Colman of National Bank Financial said the tariffs against USA goods could increase demand for agriculture from other countries.

Meanwhile, Davidson said replacing USA soybeans will be challenging because Canada doesn’t have the extra volume even though it is the fastest-growing field crop in the country.

His note comes as global markets sell-off on fears that a full scale trade war may break out. Anything that destabilizes that is a cause for concern.

Nielsen says the administration wants the National Guard’s help providing surveillance along the border and maintenance for border patrol vehicles and aircraft to free up law enforcement assets for securing the border.

Economists had previously warned the Trump administration’s move to slap China with the tariffs could prompt Beijing to retaliate and lead to higher prices for American consumers. Corn growers are particularly nervous about the impact that the NAFTA talks could have on their exports to Mexico, this region’s largest foreign market.