Here’s why Tesla could lose big in US-China trade war

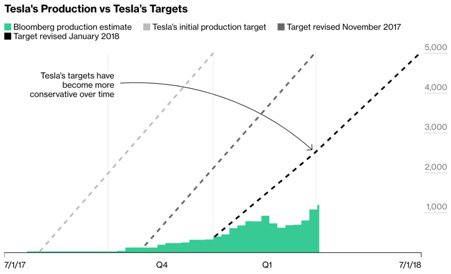

Tesla reported total production in the first three months of the year of 34,494 vehicles, up 40% from the final quarter of last year as output of the Model 3 surged fourfold from the previous quarter. Tesla made 2,020 units of the Model 3 during the last seven days of Q1, well short of its 2,500 weekly target.

24,728 of the cars manufactured were Model S and Model X vehicles, down 3,592 from the 28,320 luxury vehicles that Tesla pushed out in Q4 2017.

Tesla Inc.is under enormous pressure to build the Model 3 fast enough to meet customer demand – and to bring in revenue to offset billions of dollars spent preparing for its rollout. Tesla delivered 29,980 cars in its first quarter, including 11,370 Model S sedans, 10,070 Model Xs, and 8,180 Model 3s. Now, as it tries to double or triple that number, the company and its chief executive, Elon Musk, are getting a lesson in how hard it is to mass-produce automobiles.

Tesla shares are currently bouncing back on Tuesday, trading up 4.27% to $263.32 per share as of writing. On top of that, Tesla engages in the design, manufacture, maintenance, installation, sale and lease of solar energy systems to commercial and residential clients. Investors have grown concerned as the company has struggled with what it has called “production hell.”

The US car maker is already hindered by China’s current 25 per cent import tax that catapults the sticker price beyond the means of most consumers.

The increased production comes after a succession of bad news for the company this year, which started with low production numbers in the fourth quarter when the company made only 2,425 Model 3s. In the service centers on the recalled Tesla Model S will replace these parts.

“We could have done the coast-to-coast drive but it would have required too much specialised code to effectively game it”, Musk said on an earnings call. Service campaign will affect 123 000 electric Model S. the Reason the bolts in the power steering, which are subject to excessive corrosion.

“It’s pretty likely they’re going to have to go to the capital markets in the not-too-distant future”, said Bruce Clark, a credit analyst at Moody’s Investors Service.

The company expects the Model 3 production rate to “climb rapidly through Q2”, it said. (TSLA) stock. Now we observed the different factors that seen on close of Monday session. While the Short-Term Technical Indicators for the stock on 7-Day Average Directional Indicator shows “Sell” signal. “This has little to do with a car”.