Cord-cutting clouds Disney outlook

Its media networks revenue rose 5%, while parks and resorts sales rose 4%.

Analysts see fourth quarter Disney revenues at $13.5 billion, up 9.2 percent from the fourth quarter of 2014. Miller set a price target of $138 for Disney primarily based on the China theme park, and estimates quarterly earnings of $1.43 per share and $13.2 billion revenue.

The stock was down 2 percent in after-hours trading this afternoon.

A conference call to discuss Walt Disney Co.’s financial results Tuesday became a forceful defense of ESPN in an age of cable cord-cutting, reflecting Wall Street’s concerns about the future of one of the media world’s most lucrative brands. Because the company wasn’t able to purchase currency hedges at rates as attractive as it did a year ago, the strong U.S. dollar will lower operating income next fiscal year by about $500 million, she said. Finally, Barclays increased their price target on shares of Walt Disney from $94.00 to $100.00 and gave the company an “equal weight” rating in a research report on Monday, July 20th.

Overall, one research analyst has assigned a Hold rating and 11 research analysts have given a Buy rating to the stock.

In particular, the December. 18 premiere of Star Wars: The Force Awakens, the seventh installment in George Lucas’ saga that Disney bought for more than $4 billion in 2012, is expected to ripple into merchandising, especially with the release tied to the Christmas holiday.

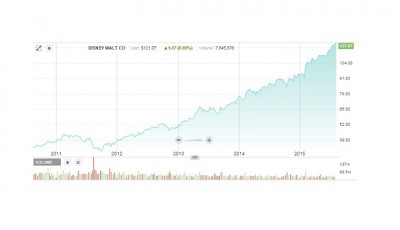

Shares of Walt Disney (NYSE:DIS) traded up 0.47% during trading on Tuesday, reaching $121.69. Separately, on the same day, RBC’s David Bank reiterated a Buy rating on the stock and has a price target of $130. The firm’s revenue was up 5.1% on a year-over-year basis. A total of 1,791 shares of the company’s stock traded hands.

The media networks segment includes sports channel ESPN, the Disney Channels and the ABC broadcast network. The company has a market capitalization of $206.48 billion and a price-to-earnings ratio of 26.18. Studio revenue increased 13 percent. Walt Disney Parks and Resorts (NYSE:DIS) is a provider of family vacation and leisure encounters.

Consumer products revenue increased 6 percent to $954 million, and operating income was up 27 percent to $348 million.