Berkshire profit falls 37 percent on investment, insurance slump

If you add up the investment income and the operating income from the conglomerate structure, Berkshire Hathaway made $4.01 billion in net earnings – down from $6.395 billion a year earlier. Profit at the business increase 4% to $963 million as the company invested billions in line expansion, new equipment and additional hiring after a lackluster 2014 when customers complained of missed deadlines. During the second quarter, its non-insurance investments and derivatives positions offered little help to offset falling operating earnings from its insurance companies.

Meanwhile, total revenue rose 3% to $51.37bn and book value per share, Buffett’s preferred measure of growth, improved 2% over the quarter to $149,735.

Berkshire’s Class A shares closed Friday’s regular trading session at $215,462.77, down $187.23.

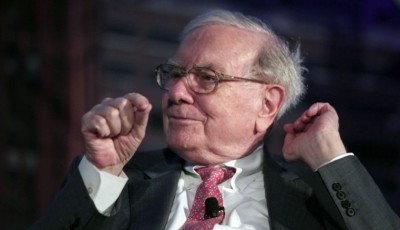

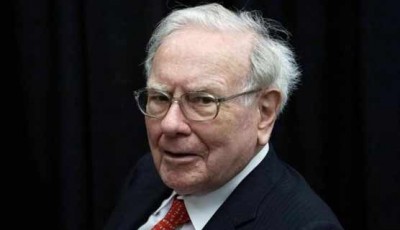

Warren Buffett’s Berkshire Hathaway Inc said on Friday its second-quarter profit fell 37 per cent, reflecting a significant decline in investment gains and an underwriting loss from insurance operations, which include Geico.

The four analysts surveyed by FactSet expect Berkshire Hathaway to report operating earnings per Class A share of $2,997.14.

Berkshire is a holding company with a number of operating subsidiaries like auto insurer Geico, reinsurer General Re, railroad BNSF, lubricant maker Lubrizol, energy utilities and a host of other manufacturing and retail companies. GEICO’s underwriting profit fell sharply to pre-tax profits of $53 million, down from $393 million in the second quarter of 2015. Claims frequencies increased in the first half of the year in all major policy areas, including collision policies, which were up about 4% and property damage and bodily injury policies, up 6%, Berkshire Hathaway said. And how much more skeptical will the press be without Warren Buffett? While investment results fluctuate from quarter to quarter, most of the company’s earnings now come from operating businesses. Buffett’s crew also lost a sum of -$113 million from derivatives in the second quarter, down from a gain of $101 million a year earlier.

Berkshire has the ability to make more big acquisitions, having ended the quarter with $66.59 billion of cash. After backing H.J. Heinz’s merger with Kraft Foods Group Inc.in July, Berkshire holds common shares in Kraft Heinz Co. valued at about US$26 billion. Buffett likes to keep around $20 billion on hand as a backstop for the insurance business. A 50-to-one stock split in 2010 set the current ratio at one-1,500th the price of a Class A share.

Berkshire Hathaway joined hands with 3G Capital to acquire Kraft. In June, Insurance Australia Group agreed to cede a fifth of its premiums and risk to Berkshire, as part of a decade-long tie-up.