Nvidia jumps 9% after smashing Wall Street Q2 earnings expectations

Schafer commented, “In light of well understood near-term PC challenges, we believe NVDA’s commitment to shareholder returns should support shares as the company awaits a new-product fueled top-line re-acceleration”. Wedbush reiterated an outperform rating and set a $24.00 price target on shares of NVIDIA in a research report on Friday, June 12th.

That seemed to suit investors just fine, and they boosted the company’s share price by almost 9 per cent in extended trading on the news. Zacks upgraded shares of NVIDIA from a sell rating to a hold rating in a research note on Thursday, July 9th. Of those thirty-two, eleven have a Buy rating, eighteen have a Hold rating and three have a Sell rating.

In NVIDIA information, insider Michael Byron marketed 43,451 shares of the firm’s inventory in a trade on Friday, May 15th. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. The stock has a 50-day moving average of $20.23 and a 200-day moving average of $21.33.

NVIDIA (NASDAQ:NVDA) last announced its quarterly earnings data on Thursday, August 6th.

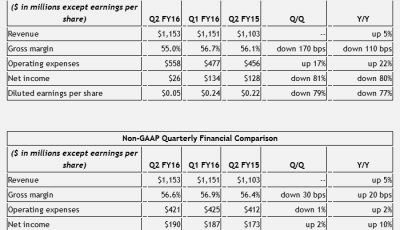

For its Q3, Nvidia guided to $1.18 billion in revenue, plus or minus 2%.

In Q2, gaming, graphics/visualization, cloud and automotive markets accounted for 85% of total revenue vs. 68% in the year-earlier quarter, Cassidy wrote.

Revenue rose 5% to $1.15 billion.

The company’s adjusted net income (including stock-based compensation but excluding interest expense related to amortization, other acquisition-related costs and other one-time items) on a proportionate tax basis came in at approximately $140 million, up 1.7% from the year-ago quarter. This translated in to an EPS of $0.05 per share. This represents a $0.39 annualized dividend and a yield of 1.70%.

NVIDIA Corporation (NASDAQ:NVDA) posted an impressive second-quarter an indication that businesses and people might be upgrading their existing computers robustly than initially thought. The Organization is engaged in creating NVIDIA-branded products and services, offering its central processing units to original equipment manufacturers (OEMs), and licensing its intellectual property.

Nvidia may be making up for some of the revenue its losing in the shrinking PC market with increasing orders for chips used in high-end desktops. And our GPU-accelerated data center platform continues to make great strides in some of today’s most important computing initiatives – cloud-based virtualization and high performance computing applications like deep learning. However, if we see its financial performance in the context of the industry it operates in, NVidia‘s financials are much better than its rival AMD who has been unable to recover from its losses, while its revenues have also gone down Year on Year (YoY).