Nvidia revenue jumps after strong gaming and automotive chip demand

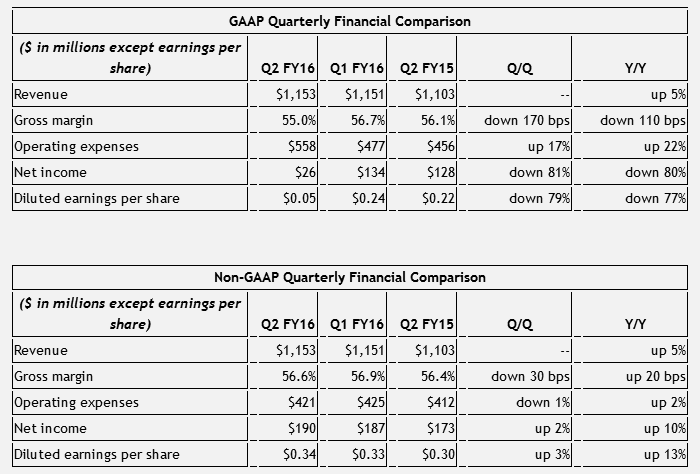

The Santa Clara, California-based company posted quarterly earnings of $26 million, or $0.05 per share, compared to $128 million, or $0.22 per share, in the year-earlier quarter.

Tigress Financial upgraded their Neutral rating to Buy on June 17. The firm has a market capitalization of $12.36 billion and a price-to-earnings ratio of 20.52. NVDA went up 10.6% in after-hours trading after the company reported better-than-expected second-quarter fiscal 2016 results.

NVIDIA Corp (NASDAQ:NVDA) stock is now trading 13.38% below its 52-week-high, 21.94% above its 52-week-low. Sales of the company’s Tegra CPUs for mobile devices were down 7.9 per cent from the same period a year ago, with the division posting revenue of $128m. The firm’s income and earnings per share look to be down significantly in the GAAP comparison charts but Nvidia notes that the GAAP financials include some hefty restructuring charges.

NVIDIA (NASDAQ:NVDA) had its cost aim upped by Topeka Capital Markets from $23.00 to $24.00in a research report report published onFriday morning, ARN reviews.

Matthew Ramsay, Canaccord Genuity: Reiterates a Hold rating, and raises his pricse target to $23 from $21.

Joseph Moore, Morgan Stanley: Reiterates an Underweight rating, and raises his price target to $21 from $18. This corresponds to a decrease of $0.06 compared to the same quarter of the previous fiscal year. The stock was sold at an average price of $21.37, for a total value of $928,547.87. The transaction was disclosed in a filing with the SECURITIES AND EXCHANGE COMMISSION, which is available at this link. Investors of record on Thursday, August 20th will be given a $0.0975 dividend.

Prior to the earnings release, most analysts are neutral on Nvidia stock; 12 recommend Buy, 18 mark Hold, whereas only three advocate a Sell rating. The ex-dividend day is Tuesday, August 18th.

About NVIDIA Since 1993, NVIDIA (NASDAQ: NVDA) has pioneered the art and science of visual computing. The Organization is engaged in creating NVIDIA-branded products and services, offering its central processing units to original equipment manufacturers (OEMs), and licensing its intellectual property. NVIDIA- services and branded products are visual computing platforms that address four markets: Gaming, Business, High Performance Computing & Cloud, and Automotive.

The company chief also exhibited excitement for enterprise graphics and cloud initiatives as Nvidia’s business customer base has more than tripled in one year to over 300 enterprises. Nvidia now supplies Tesla with a tablet like infotainment system while also working with 50 other companies with a view of getting them connected to its NVidia Drive technology.

On the downside, Nvidia’s mobile chip performance underlined exactly why the company has already said it plans to get out of that business, where it’s trailed way behind its competitors.