Bank of England Indicates Interest Rate Hikes Still Far Off

One committee member voted against the decision but the MPC voted unanimously to maintain an economic stimulus program which purchases £375 billion ($581.8 billion) in financial assets each year, the bank said in a statement.

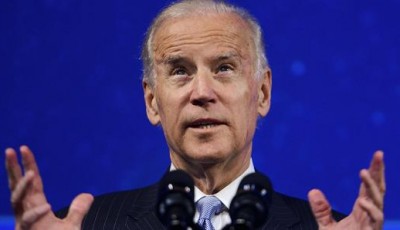

“[The increased speculation about interest rate rises is a] welcome sign that the economy is returning to normal”, he said at the BoE press conference He added that the time for a rate hike was “drawing closer” but any decision would be “data dependent”.

Meanwhile, the Bank of England’s quarterly inflation report forecast a rise in annual inflation to the bank’s 2 per cent target by the third quarter of 2017.

A massive volume of data, but no real ambiguity. But since oil prices have had another fall again recently, the overall impact of falling energy prices won’t really leave the inflation figures until the middle of 2016. If interest rates rise, the potential increased cost of debt many SMEs will have commercial mortgages and loans that will become more expensive once an increase is implemented.

The BoE communication shake-up is all part of Governor Mark Carney’s efforts to enhance transparency and make the oft-criticised UK central bank more accountable to the British people.

Despite the fact that it will affect three million people directly, the Bank expects the increase to raise aggregate pay in the economy by less than 0.5% gradually over five years.

However Peter Hemington, head of corporate finance at mid-tier accountancy firm BDO, predicted that a rate rise would come in spring 2016 and said that with geo-political risks abound, the BoE should not look to raise interest rates too soon.

‘Ahead of time, expectations were that he would be joined by Martin Weale, and possibly (very outside chance) David Miles, ‘ said James Knightley, economist at ING.

“The initial reaction from markets has been a sell-off in the pound driven by the suspicion that the Bank’s cautious outlook means that first rate rise has been pushed back to at least early next year”.

Jane Foley, senior currency strategist at Rabobank, said: “While the MPC will lay the foundation for an future interest rate hike, it is still likely to be some months before a the majority of MPC members vote in favour of a rate hike”.

“Short term interest rates have averaged around 4.5% since around the Bank’s inception three centuries ago”, said Carney in a speech on July 16.

The Bank of England said it expected inflation to be back to its 2% target in two years’ time.

“Clearly there are still economic uncertainties and the minutes and the inflation report will be a key to understanding those and also to thinking about how the MPC’s decisions might develop from here”.