Fed’s Lockhart says “disposed” to September rate hike

The Federal Reserve is expected to raise its key interest rate next month for the first time in nearly a decade.

The U.S.is to release preliminary data on unit labor costs.

But there are contrarians out there.

“Those who interpret recent Fed communication as indicating a desire to raise rates soon unless there are signs of economic weakness will expect a hike this year, probably in September“, Societe Generale’s Kit Juckes wrote in a new note to clients.

Bulls returned after piling out of gold the past two months with net long fund position (NLFP) in gold increasing by 5,435 contracts (or 19 percent) to 29,900 from 24,465 contracts in the week ending August 4, according to the latest CFTC statistics.

The Fed’s preferred gauge of inflation pressures rose 0.3 percent in June from a year earlier. After all, if the economic model to which you are totally committed is based on the assumption that money-pumping and interest-rate suppression give the economy a sustainable boost, then an unusually weak economy in the wake of aggressive intervention of this nature can only mean two things. He said the Fed has been extremely expansionary in its monetary policy.

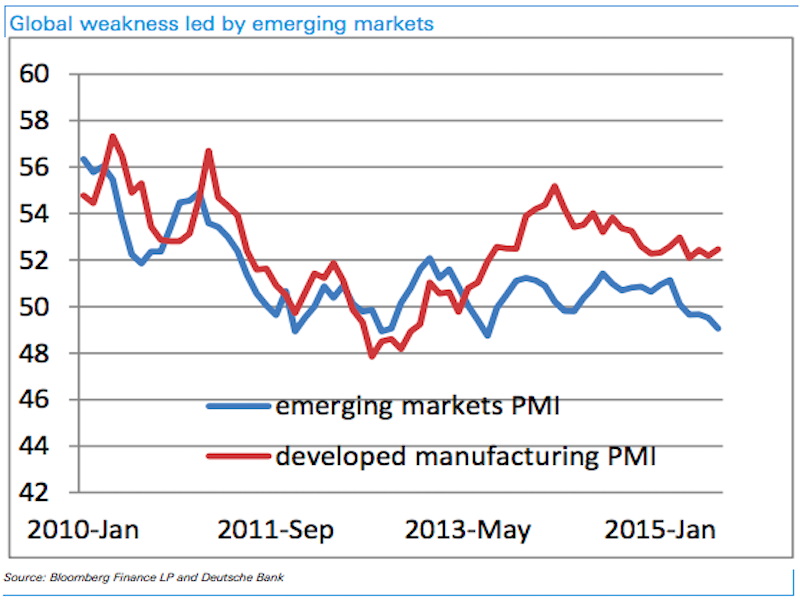

Today is a virtually data free Monday with only a few innocuous reports and some Fed speak that could have some modest influence on price discovery. Emerging market corporate bonds doubled to $6.8tn between 2008 and the end of last year, of which $1.8tn was in foreign currency. Low oil prices are a calamity for many economies.

JP Morgan Chase made what some might call an unusual move, cutting its Treasury yield forecast as it expects energy prices to tumble and weigh in on inflation expectations.

“Because this report was not extraordinarily strong, it was simply in line with expectations, that leaves markets having to look toward other data”, said Paul Christopher, head global market strategist at Wells Fargo Investment Institute in St Louis.

It would be the Fed’s first rate hike since 2006. The U.S.is to produce data on retail sales, initial jobless claims and import prices.

“Commodities entered squeeze mode following weeks of slowing downside momentum”, Triland Metals said.

“Compared to earlier in the year, we know a lot more and can shelve some concerns”, Lockhart said.

“The Fed is very concerned about the strengthening of the U.S. dollar”.

Meanwhile in the US, July Labor Market Conditions Index month-over-month was 1.1, above the previous reading of 0.8.

Economists thought Americans would spend more once the weather warmed up this spring and summer, but that hasn’t happened.

Yellen has flagged this shortcoming: “A significant number of individuals still are not seeking work because they perceive a lack of good job opportunities”, she said in July.

Should the Fed increase interest rates, the increase would be relatively small.