China devalues, Trump ‘will devastate us,’ Fiorina ‘fight Chinese aggression’

China’s government said the move to weaken the yuan was a result of reforms intended to make its exchange rate more market-oriented.

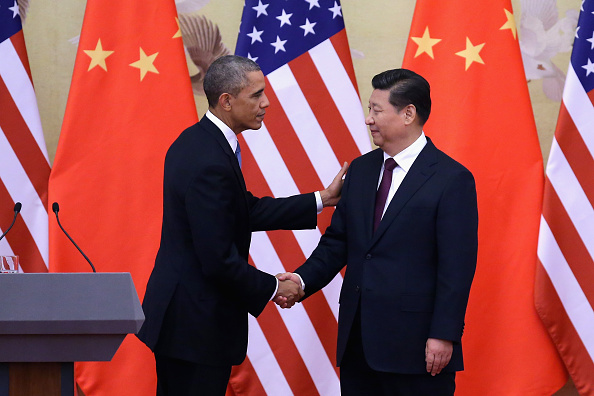

However, the devaluation was decried by U.S. lawmakers from both parties on Tuesday as a grab for an unfair export advantage and could set the stage for testy talks when Chinese President Xi Jinping visits Washington D.C. next month, given acrimony over issues ranging from cybersecurity to Beijing’s territorial ambitions in the South China Sea. Companies that sell goods in China could find revenue generated in yuan is worth less in their home currency. The devaluation triggered selling of shares, oil and other commodities on expectations of weaker demand from China. The S&P 500 is on track for its biggest drop in a month. This spring, Beijing intervened, once to encourage stock markets to inflate, and then repeatedly in an attempt to stop the irresistible plunge when savvy traders realized stocks had become unrealistically high. “Although the People’s Bank of China has stated that this is a one-off move, however, history shows that currency devaluations are followed by a series of such moves”.

The Dow Jones industrial average lost 193 points, or 1.1 percent, to 17,212 as of 9:35 a.m. Eastern time Wednesday.

China said Tuesday that it devalued the yuan, also known as the renminbi or RMB. For India, the devaluation could mean “triple whammy” in the form of rise in rupee volatility, exporters facing more competition and China dumping more goods into India, it said. The yuan was valued at 6.32 per dollar on Tuesday, compared with 6.21 per dollar a day earlier. The fast-food company gets more than half of its sales from China, according to data from FactSet.

Last year, China shut down a bilateral working group on cyber security after the United States charged five Chinese military officers with hacking American firms. Brands and Tiffany each dropped 4 percent. Oil, which for a while this week seemed to be recovering again, hit fresh lows for the year. Morgan Stanley said Wednesday that China’s export of deflationary pressures “is not a marginal event” given its $10 trillion economy and a deepening slump in producer prices.

A second cut on Wednesday brought reductions this week in the yuan to 3.5 per cent against the dollar to its lowest level in four years.

ENERGY: U.S. crude rose 57 cents to $43.65 a barrel in electronic trading on the New York Mercantile Exchange.

The devaluation sparked fears of a global “currency war” and accusations that Beijing was unfairly supporting its exporters, but the central bank on Wednesday sought to reassure financial markets that it was not embarking on a steady depreciation.

“Two percent is no big deal”, said Mark Zandi, chief economist at Moody’s Analytics, said Tuesday. “Investors will go where the exchange rate gives them better bang for buck”. Google’s stock gained $27.16, or 4.1 percent, to $690.30. The yield on the 10-year Treasury note, which moves in the opposite direction to its price, fell to 2.14 percent from 2.23 percent on Monday. The euro rose to $1.1045 from $1.1021.

The currency fell as much as 1.98% Wednesday to 6.4510 in late afternoon trade, closing in on the weakest level regulators allow the currency to trade each day.

Gold rose for the fifth consecutive day, hitting a three-week high of $1,119.890 an ounce.