China allows its currency to drop for a third day

The Chinese exchange rate for the yuan fell over 1% overnight even as Peoples’ Bank of China (PBOC) officials tried to stem the decline with verbal and monetary support.

At a news conference in Beijing, he also said that the yuan – also known as the renminbi – was close to “market levels” after two days of substantial declines.

Yi Gang, deputy governor of the central bank, said it stood ready to step in if volatility became “excessive” and the market started “behaving like a herd of sheep”.

ANALYST VIEW: The Chinese central bank’s “opaque communications policy may well have led to panic over-selling earlier in the week”, Angus Nicholson of IG markets said in a commentary.

Thursday’s yuan guidance rate was set 1% down, a smaller margin than the shock cuts earlier in the week.

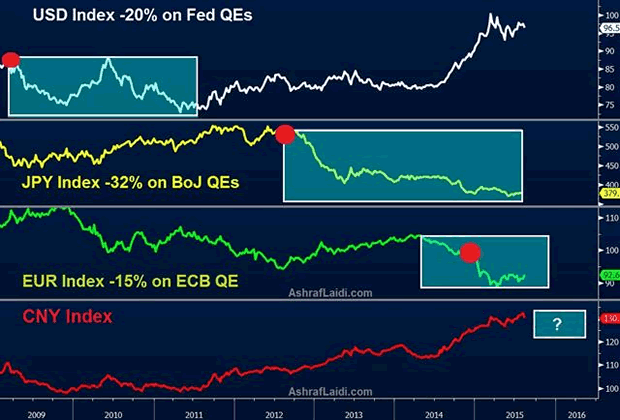

Then there’s the chance that other countries will adopt copycat devaluations to help their exporters compete with China, thereby igniting a currency war that disrupts global trade.

Japan’s Nikkei Stock Average was about flat, while Australia’s S&P ASX 200 was up 0.2%.

Banking sources said the People’s Bank of China had stepped up its intervention in yuan trading in a bid to stabilise exchange rates. Oil fell 0.4 percent, while nickel headed for a 2.3 per cent loss since August 7. But on Tuesday it moved the fix by 1.9% and said in future that it would base the fix on the previous day’s market rate rather than its own judgement.

But the Chinese central bank argued that its goals were more mundane than manipulating exports and growth.

Tuesday’s devaluation followed a run of weak economic data and resulted in the biggest one-day fall in the yuan since 1994, raising market suspicions that China was embarking on a longer-term depreciation of its exchange rate that would make Chinese exports cheaper.

China’s rivals see it as a way to boost exports and prop up the market.

China keeps a tight grip on its currency on worries sudden fund outflows or inflows could cause more financial risk and challenge its control, but it has also pledged to move towards more flexibility. “They’ll get some relief on costs, and these companies will likely welcome the drop in China’s currency”, he said.

China’s decision to move from a pegged exchange mechanism to a managed-float system has partly been driven by the strengthening US dollar, the currency to which it has historically been pegged.

Emerging market currencies including the Indonesian rupiah, Philippine peso and South Korean won rose slightly against the dollar after China yesterday trimmed its yuan reference rate 1.1 percent.