Back-To-School Sales Tax Holiday Starts Friday

“The hurricane tax free weekend is being combined with the back to school weekend”, said Kenneth Ryder, Winchester’s Home Depot Lumber and Building Supervisor.

The back to school tax holiday applies to all sales taxes, state and county, and is offered for the first time in Ohio. “Florida’s more than 270,000 retailers have been preparing for this popular holiday and are ready with great sales and opportunities for shoppers to save on clothing, supplies and technology items”.

Many local governments also suspend local sales taxes during the sales tax holiday.

“I’m buying for school, my son is beginning school this year and has to wear uniforms, so I figured this was a good time to buy uniforms”, Jennifer Costner said. Although it’s unclear who might head to the movies to stock up on school supplies, a souvenir T-shirt will still be taxed. According to the National Retail Federation’s annual survey, families with children in grades K-12 plan to spend an average of $630 on back-to-school shopping.

Illinoisans are not getting a break on back-to-school supplies such as those in more than a dozen states enjoying tax-free holidays.

“It saves you quite a bit of money just coming out and saving that tax on the tax-free weekend”, said Lisa Terranova.

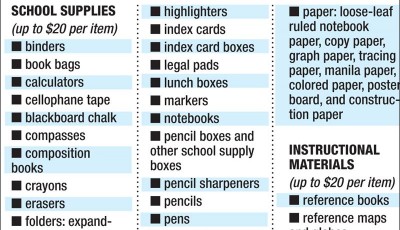

School supplies priced at $20 per item or less are tax free, too; however, that means no big ticket items like phones, laptops or computers. We all pay the State sales tax at 5.75% – so nearly six cents on every dollar.

During the 2015 session of the General Assembly the holidays were officially combined into a single event to take place for three days in August and to include all the items previously represented.

To get the holiday exemption, customers can shop in stores and online or through catalogs that normally charge Ohio sales tax, he said.