S and P in praise of Chinese yuan devaluation

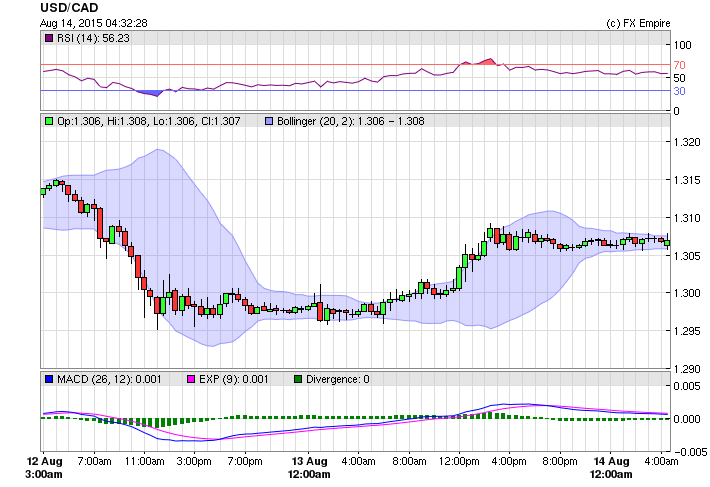

TOKYO-The U.S. dollar was almost unchanged against the yen and the euro in Asian trade Friday, as investor sentiment improved on signs of stability in the Chinese currency.

Earlier on Wednesday, the PBoC warned it was not pursuing steady depreciation in response to allegations that Beijing was manipulating the currency to boost exports.

In actual trading the yuan eased just 0.2% vs. the dollar, Barclays said. “This will eventually have a positive impact on global commodity prices – including oil prices, which in turn will strengthen the ruble”, Russia’s Central Bank said in a statement. In a press conference, the PBoC was “downplaying the need for a weaker yuan“, Barclays said.

The cut was less than the previous two days and came after reports the People’s Bank of China (PBoC) intervened Wednesday to stem the yuan’s fall. Beijing doesn’t let buying and selling in financial markets set its exchange rate the way the United States and other developed countries do. Dalmia pointed out that the Chinese government appeared to be more sensitive to the decline in their exports than the Indian government as they had acted with alacrity to arrest the decline in their exports by taking urgent steps like devaluing their currency.

The move – prompted by Beijing’s concerns about an economic slowdown and an overvalued yuan making China’s exporters less competitive – wiped nearly £1trn off shares worldwide in two days, amid worries over a fresh escalation of global currency wars.

“The central bank, if necessary, is fully capable of stabilizing the exchange rate through direct intervention in the foreign exchange market to avoid the herd mentality resulting in irrational movements of the rate”, he said. China’s Shanghai Composite Index added 0.8 percent to 3,987.57.

Previously, it said it based the fixing on a poll of market-makers, but declared it would now also take into account the previous day’s close, foreign exchange supply and demand and the rates of major currencies.

Under a managed floating exchange rate system, the value of the yuan is determined by the market.

Analysts said the PBOC’s steadying of the yuan had calmed the markets. But the long-expected slowing of China’s economic growth has dampened the enthusiasm of some foreign investors. During the three sessions, the yuan fell more than 3 percent against the U.S. dollar before it rebounded on Friday.

Against the China backdrop, Fisher did talk about the challenges of not raising US interest rates at the Fed’s meeting next month.