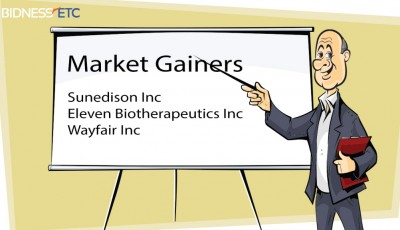

SunEdison, Goldman Sachs funds form $1 billion investment vehicle

TerraForm stock rose 1.3% Monday to 25.83, but it’s down almost 40% from its all-time high of 42.66, touched in April. The company has a market cap of $4.24B and a P/E ratio of 0. On July 20, 2015 The shares registered one year high of $33.45 and one year low was seen on August 12, 2015 at $11.78.

Baird is focused on SunEdison’s ability to consistently execute its backlog/pipeline activities as well as reduce 2016 and 2017 growth targets, which would assist the company to successfully ramp deployments without sacrificing project quality. The company has been rated an average of 1.86 by 7 Wall Street Analysts.

SunEdison Inc (NYSE:SUNE) stock is now trading 57.73% below its 52-week-high, 20.03% above its 52-week-low. Underwriters had planned to sell 56.6 million shares for $19 to $21 a share and raise more than $1 billion. SunEdison, Inc. (NYSE:SUNE) distance from 50-day simple moving average (SMA50) is -49.15%. Finally, Bank of America restated a buy rating and set a $34.00 price objective (up previously from $32.00) on shares of Sunedison in a research report on Saturday, May 23rd. SunRun, the third leading U.S. solar installer, made its initial public offering at $14 per share but closed Thursday at just over $10. As per the latest research report, the brokerage house lowers the price target to $28 per share from a prior target of $45. Under the terms, Dominion will invest around US$500 million, and SunEdison, $150 million. The company reported ($0.93) EPS for the quarter, missing the analysts’ consensus estimate of ($0.55) by $0.38. “With this new technology, Atmel’s SmartConnect wireless and IoT solutions now support Intel EPID, a security technology that has been proven over the last 5 years”.

Joel Ivy, Lakeland Electric’s general manager, said the company was excited to expand its renewable energy portfolio and that the accompanying power purchase agreement (solar PPA) with SunEdison will enable Lakeland Electric to provide its customers with predictably priced, low-cost electricity.

Much of the new issuance has come from “yieldcos” – bundles of solar, wind or other power plants with long-term utility contracts that are spun off by developers into a dividend-paying public entity. The Company’s Solar Energy segment provides solar energy services that integrate the design, installation, financing, monitoring, operations and maintenance portions of the downstream solar market for the Company’s customers. The Company’s Semiconductor Materials segment includes the manufacture and sale of silicon wafers to the semiconductor industry.