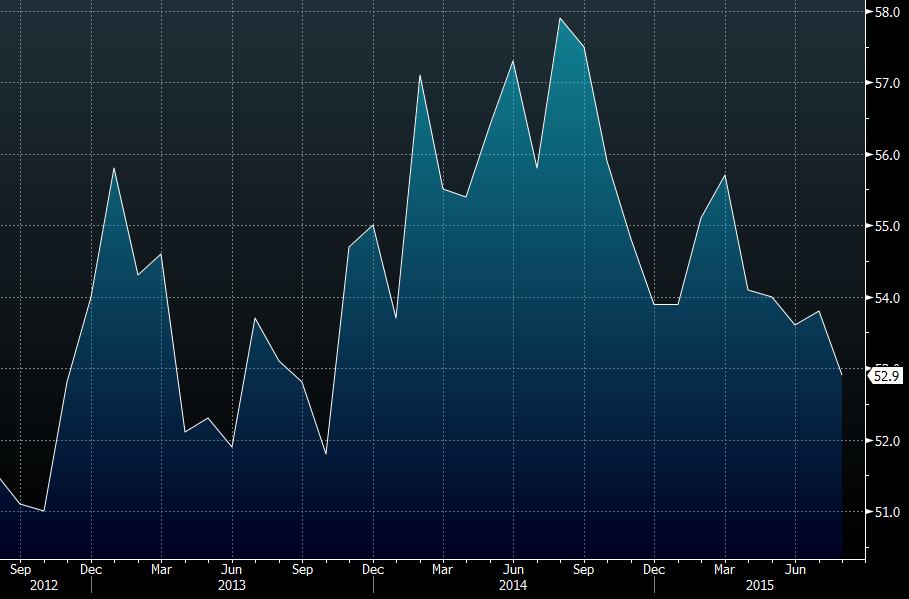

Caixin flash China general manufacturing PMI hits 77-month low in August

The Caixin Chinese Purchasing Manager’s Index, formerly released by HSBC, showed that manufacturing activity in August slowed to a six-and-a-half-year low. Markit’s Composite Flash Purchasing Managers’ Index, based on surveys of thousands of companies and seen as a good guide to growth, rose to 54.1 this month from July’s 53.9.

A reading above 50 indicates expanding activity and one below 50 signals contraction. This is mainly because the GDP growth rate has remained at a reasonably high level and the services sector has been strong, it explained.

He said job creation was “particularly pleasing”, especially in countries “still struggling with double-digit rates of unemployment” such as Spain and Portugal.

The index’s output component fell to 53.7, its lowest since January 2014, from the July final reading of 55.3. It is an overall measure of the health of China’s manufacturing sector.

China’s economy is grappling with industrial overcapacity, the fallout from a downturn in property investment and a volatile stock market.

(1000 ET/1400 GMT) Euro Zone August consumer confidence index – flash, -6.9 eyed; last -7.1.

One sign that Beijing is unwilling to let the economy slow significantly has been a recent pick-up in credit growth, often regarded as the single most important factor in China’s economic performance.

China’s yuan has also experienced unexpected volatility, after the central bank allowed the currency to sharply depreciate.

China’s surprise devaluation of the yuan last week and a near-collapse in its stock markets in early summer have sparked fears that it could be at risk of a hard landing which would hammer world growth, sending financial markets into a tailspin.

The figures indicate that the eurozone economy is on track to grow 0.4% in the third quarter from the second, marking a slight acceleration from 0.3%, data firm Markit said.

The turmoil in stocks, which saw equities around the around nose down, led some forecasters to predict that the Federal Reserve will hold off on raising interest rates.

“The PMI was a very disappointing number and confirms the need for more targeted stimulus from China”, said Sue Trinh, a senior currency strategist at Royal Bank of Canada in Hong Kong.

Japan’s factory sector continued to expand in August, according to an industry gauge, raising hopes that the economy will return to growth this quarter.