Brocade Communications Systems, Inc. Analyst Rating Update

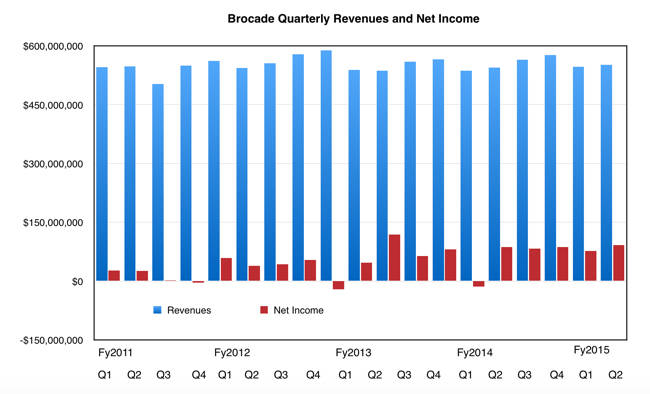

Brocade Communications Systems (BRCD – Get Report) is scheduled to release its 2015 third quarter earnings results after the market close on Thursday afternoon. The Company reported GAAP diluted earnings per share (EPS) of $0.21, up from $0.20 in Q3 2014 and up from $0.18 in Q2 2015. Tax benefits recognized in THIRD QUARTER 2015 surged both GAAP and non-GAAP diluted EARNINGS PER SHARE by about $0.02 in the quarter. (NASDAQ:BRCD): According to 10 Analysts, The short term target price has been estimated at $ 12.3.The target price could deviate by a maximum of $2 from the forecast price. BMO Capital Markets decreased their price objective on shares of Brocade Communications Systems from $13.00 to $12.00 and set a “market perform” rating for the company in a research note on Friday. Its 52-week high is $56.68 and so far in this year the stock has moved up 17.65%.

In other Brocade Communications Systems news, Director Judy Bruner sold 5,000 shares of the business’s stock in a transaction dated Wednesday, May 27th. The disclosure for this sale can be found here. The company has a 52-week high of $12.96. The company earned $552 million during the quarter, compared to analyst estimates of $550.85 million. As per the latest research report, the brokerage house lowers the price target to $9 per share from a prior target of $11.5. Equities analysts anticipate that Brocade Communications Systems will post $0.98 earnings per share for the current fiscal year. The stock had a trading volume of 18,552,830 shares.

The business also recently disclosed a quarterly dividend, which will be paid on Friday, October 2nd.

BRCD shares were up almost 8% at $10.49 apiece, earlier topping out at $11.28 a share. (NASDAQ:BRCD) at 2.88. Research Analysts at Zacks have ranked the company at 3, suggesting the traders with a rating of hold for the short term. The Company shares has received a rating of Buy from 3 Wall Street Analysts.

Brocade Communications Systems, Inc. (Brocade) is a supplier of networking equipment, including end-to-end Internet Protocol (IP)-based Ethernet networking solutions and storage area networking solutions for businesses and organizations of all types and sizes, including global enterprises, and service providers, such as telecommunication firms, cable operators and mobile carriers. The firm has a market cap of $4.40 billion and a PE ratio of 13.88.

Brocade said it achieved 43 percent growth in IP Networking product revenue from service providers and 32 percent increase in revenue from U.S. federal. Its services and products are advertised, sold and supported worldwide to end user customers through distribution partners, including original equipment manufacturers, vendors, systems integrators, value-added resellers and directly to end-users by the Brocade direct sales force. The Company operates in four segments: Data Storage, Global Services, IP Layer 2- IP Level 4 and 3 -7/ Program Delivery Products.