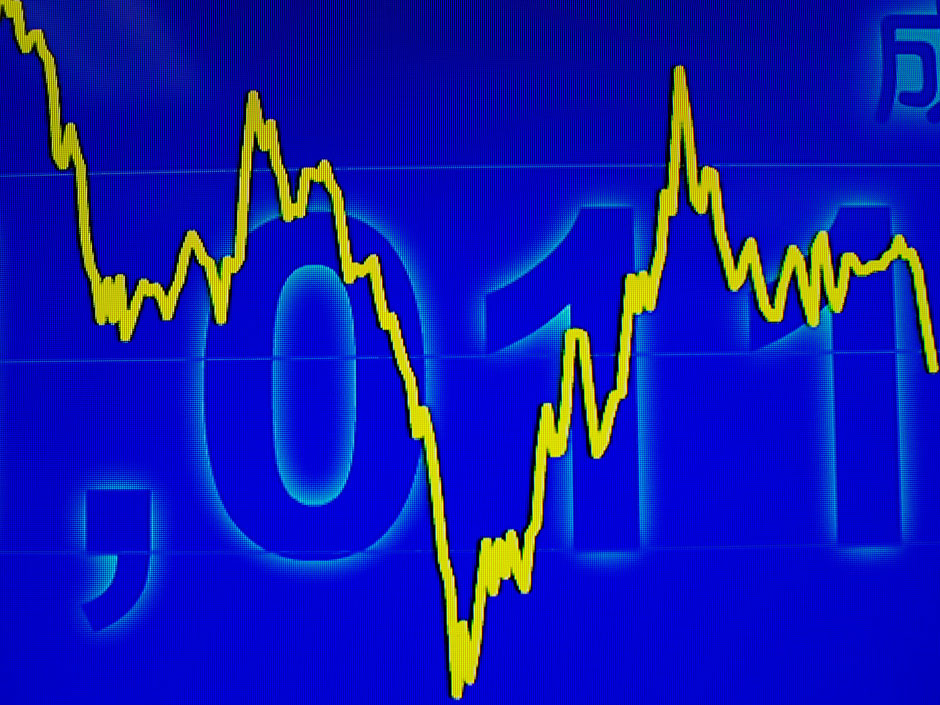

Asian stocks tumble to lowest level in three years

Japan’s Nikkei 225 Index dropped by 4.61% to 18,540.68.

Asian markets are down, but by far less. In the meantime, things can get worse. The rout is shaking confidence that the global economy will be strong enough to withstand higher US interest rates.

Yet the question of whether the Chinese government, which has set great store on using the stock market to raise funds for the country’s industrial restructuring, would take further action to prop up the market – as it did in July with a series of measures including massive spending by government-backed investment funds – remained a focus of attention.

Europe is following with triple digit losses in England, Germany and France in early afternoon trading.

On the mainland, the volatile Shanghai Stock Exchange Composite Index (SHCOMP) fell 7.63% to 2,964.97, sinking below 3,000 for the first time December.

“I’ll be surprised if the syndicates will rush their clients out now with the broader sentiment much weaker globally”, Ken Lee, Managing Partner at Ark One, a Hong Kong-based credit fund, said.

Heavyweight securities firms were among the biggest losers in Shanghai, where more than 800 shares fell by their 10 per cent daily limit, according to Bloomberg News. As of 0:33 a.m. EDT, the ASX 200 was trading down 3.36 percent at 5050 points, while the All Ordinaries was down 3.25 percent to trade at 5045 points.

The Bank of East Asia, one of the largest local banks in Hong Kong, rose 1.53% to close at HK$26.50 (US$3.41).

The two most important crude futures, U.S. West Texas Intermediate (WTI) and the global benchmark Brent, hit fresh 6-year lows on Mondays to levels last seen during the peak of the credit crunch of 2008/2009.

The yuan devaluation was widely seen as meant to give Chinese exporters – a key sector of the economy – a boost by making their products cheaper overseas.

Energy stocks were hammered along with real estate and gold, as crude oil prices collapsed to new six-year lows near $38 a barrel. With the Shanghai and Shenzhen Composite indexes now down 37% and 39%, respectively, from their June 12 peaks, there is little sign of them reopening soon. The main KOSPI Index was down by 2.00% at 1,838.57.