Ackman takes $5.5bn chunk of Mondelez, mulls takeover

Billionaire activist investor William Ackman’s hedge fund has built a $5.5 billion stake in Cadbury chocolate and Oreo cookies maker Mondelez worldwide Inc (Xetra: A1J4U0 – news), which could become a potential target in a consolidating food industry.

Peltz, who said in April that he was not pushing Mondelez to do a big deal, was quoted by CNBC on Thursday as saying that he was pleased with Ackman’s investment.

According to Pershing Square Capital Management, it wants to inform the Securities and Exchange Commission that it having a 7.5% stake in the company that includes options and forward contracts.

Pershing Square Holdings, Ltd. (ticker: PSH:NA) announced today a new position in Mondelez worldwide, Inc. “We’ll continue to focus on executing our strategy and on delivering value for all our shareholders”.

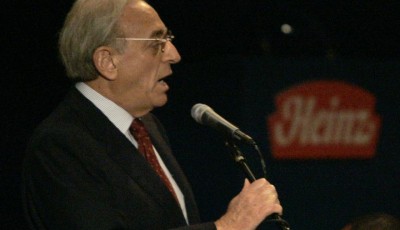

Bill Ackman, founder and chief executive officer of Pershing Square Capital Management LP. Known for aggressive cost cutting moves, 3G Capital is in the process of pulling what it says are hundreds of millions in excess costs from Kraft Foods, something the firm was able to accomplish when teaming up with Warren Buffett on the buyout of Heinz. Peltz joined Mondelez BoD in January 2014 after another public campaign, this time to cut costs and merge with PepsiCo Inc. Up to the close of the market on Wednesday, Mondelez shares had risen 27.4% this year.

Ackman is closely associated with Herbalife. Part of the logic behind the breakup was that Mondelez would be more nimble without Kraft’s mature North American operations.

“He has been following this story about the margin expansion opportunity on the Mondelez side of the business since before the Kraft Foods company split back in 2012″.

Argus Analysis analyst John Staszak stated it seems to be like Ackman is banking on additional consolidation within the meals business.

Adding to the intrigue surrounding Ackman’s investment: He’s not the only activist investor involved in the company.

Kraft is now set to mix with H.J. Heinz to type Kraft Heinz, creating one of many world’s largest meals corporations with manufacturers like Jell-O and their namesakes. He pushed for a merger between PepsiCo and Mondelez in July 2013.

He is open to an acquisition of Mondelez from a rival, including Pepsi or Kraft Heinz, these people said.

Mondelez has made some steps to boost its performance, including shutting factories and setting a share buyback of up to US$13.7 billion.

In our view, Kraft Heinz’s biggest need will be worldwide – particularly developing market-scale in non temperature controlled distribution.