Advanced Micro Devices Inc

The current share price indicate that stock is -1.32% away from its one year high and is moving 171.08% ahead of its 52-week low. Schulhoff & Co Inc owns 86,985 shares or 2.3% of their U.S. portfolio. When recommending NVDA, Schafer earns 0.0% in average profits on the stock. For trailing twelve months, EPS value for the stock is $1.82. (AMD) is an interesting player in the Technology space, with a focus on Semiconductor – Broad Line. Anything short of that rosy scenario could hurt the stock, and investors seemed inclined to agree, based on today’s trading. ATR can display volatility of stocks, ETFs and indexes. At the time, this indicated a possible downside of -0.04%.

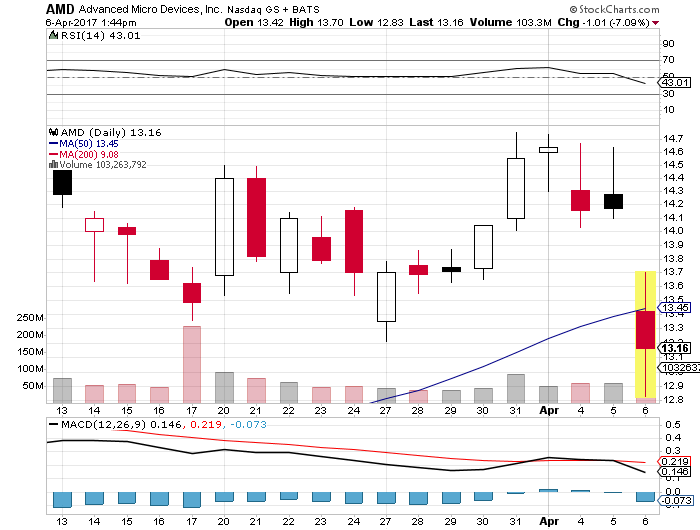

Earnings per share (EPS) breaks down the profitability of the company on a single share basis, and for Advanced Micro Devices, Inc. the EPS stands at -0.01 for the previous quarter, while the analysts predicted the EPS of the stock to be -0.02, suggesting the stock exceeded the analysts’ expectations. Latest closing price was -27.23% below its 50-day moving average and -27.23% below its 200-day moving average.

During last 5 trades the stock sticks nearly 3.43%. Blair William Il holds 11,580 shares or 0% of its portfolio.

During last 12 month it moved at 413.04%. Over the past month the firm’s stock is 8.58%, 23.97% for the last quarter, 103.30% for the past six-months and 406.07% for the previous year. Finally, Susquehanna Bancshares Inc upped their price target on Advanced Micro Devices from $9.00 to $12.00 and gave the stock a “neutral” rating in a research note on Monday, March 20th. Typically, they estimate what the company’s earnings and cash flow will be for the next couple of years, and then apply a ratio – such as a price-to-earnings ratio – to those estimates to determine what the future stock price should theoretically be. AMD’s value Change from Open was at -1.05% with a Gap of -2.25%. Sales growth past 5 years was measured at -8.20%. It has a 17.2 P/E ratio.

A total of 19 analysts have released a report on Advanced Micro Devices. (AMD) stands at 2.60. One research analyst has rated the stock with a sell rating, seventeen have assigned a hold rating, ten have issued a buy rating and one has issued a strong buy rating to the stock.

03/24/2017 – Advanced Micro Devices, Inc. had its “buy” rating reiterated by analysts at Jefferies. The stock now shows its YTD (Year to Date) performance of 24.96 percent while its Weekly performance value is 3.36%.

Hari said he expects the stock to start underperforming the market after AMD’s analyst day in May. 13 advised “Hold Rating” regarding the stock.

While a Sell rating seems harsh, Goldman Sachs is actually above consensus estimates, with revenue projections of $4.87 billion (versus $4.73 billion). The stock of Endeavour Silver Corp (NYSE:EXK) earned “Market Perform” rating by BMO Capital Markets on Tuesday, April 4.

We’ve taken a serious look at this stock from a fundamental perspective, but the tale of the tape may offer more hints about what lies under the surface.

Several institutional investors have recently bought and sold shares of the company. Your own financial situation and investment needs are what matter. Remember, you are the boss, it’s your money, and your situation and goals that matter.