Ahead of OPEC Meeting, Oil Prices Gain Despite New U.S. Rigs

Saudi Arabia, OPEC’s largest producer and the world’s largest crude oil exporter, has set the precedent with its minister recently saying production this month was less than 10 million b/d, its lowest output in nearly two years after hitting highs of 10.72 million b/d late last year. Analysts see West Texas Intermediate averaging US$60 a barrel in 2018, according to the median of 30 estimates compiled by Bloomberg, just US$5 higher than what they were forecasting a year ago for 2017. The contract dropped $1.55, or 2.8 percent, to $53.92 on Wednesday. The price for Brent crude oil was up about 1.7 percent about an hour before the start of trading in NY to $55.11 per barrel.

To hear Mohammed Barkindo, secretary general for the Organization of the Petroleum Exporting Countries (OPEC) tell it, the first fortnight of the cartel’s implementation of its highly-criticized production cutback agreement is nothing but good news, with “tremendous efforts” being made by all 24 participants involved in the deal.

Saudi Arabia cut its production to under 10 million barrels per day in early 2017, below what’s been set forth in OPEC’s broad agreement to cut production. “We’re starting to see declines but it will take a while to cut through them”.

Earlier Barkindo stated that OPEC and non-OPEC producers agreed to establish a joint ministerial monitoring committee and a Vienna meeting would adopt an oversight and compliance mechanism.

“This is a more responsive supply market than in the past”, said Sam Ori, executive director of the Energy Policy Institute at the University of Chicago in an interview.

The Paris-based energy agency says that if OPEC were to comply with the deal, it would imply a drawdown in global inventories on the order of 0.7 mb/d for the first six months of 2017.

Production cuts by OPEC won’t necessarily trigger a “bonanza” of USA shale and other supply, the International Energy Agency said. “We may stay below that level for a while because of high inventories”.

OPEC began flooding the global marketplace with oil in 2014 in an attempt to depress prices to counter competition, largely from fracking.

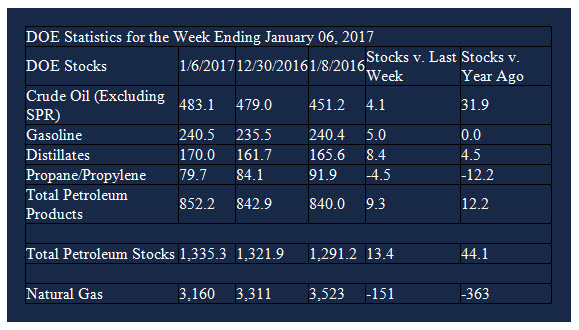

Analysts remain cautious about future price gains because of the overhang of inventory and the increased output of US producers, which can dampen growth and cause prices to decline. The wider watched report from the Energy Information Administration is due later today at 1600 GMT and it is looking for a 1-million barrel decline. That will offer an indication of oil activity.

The Baker Hughes North American rig count data that tracks weekly changes in the number of active operating oil & gas rigs is expected at 1 pm ET.

And Donald Trump as president of the United States is expected to ease restrictions on oil drilling, which could contribute to higher domestic production.

“The coming weeks will provide more clarity and in the meantime developments elsewhere in the oil supply/demand balance are very intriguing”, it added.