AK Steel Holding Corp (AKS): Following the Indicators

(X)’s RSI (Relative strength index) is at 74.53, its ATR (Average True Range) value is 1.07, while its Beta factor was calculated at 2.98. If you are accessing this piece of content on another domain, it was illegally stolen and republished in violation of United States and global copyright and trademark law. AKS has diverse figures for different time frames; starting from week’s performance it going forward toward positive percentage of 1.93% in last five regular trading sessions. The average daily volatility for the week was at 3.8%, which was 0.44 higher than that in the past month.

Several institutional investors and hedge funds have recently made changes to their positions in X. Amerigo Asset Management bought a new position in United States Steel in the third quarter valued at approximately $158,558,000. The short ratio in the company’s stock is documented at 1.74 and the short float is around of 11.33%.

The company reported its last earnings Actual EPS of $0.92/share. Unilever Plc now has $148.18 billion valuation.

The stock increased 0.23% or $0.05 during the last trading session, reaching $21.46. About 394,357 shares traded. Unilever PLC (NYSE:UL) has risen 20.68% since December 14, 2016 and is uptrending. It has outperformed by 14.45% the S&P500. (NYSE:X) received a Buy rating from 2 analysts. AKS was included in 75 notes of analysts from July 29, 2015. “(X) Stock” was reported by TrueBlueTribune and is owned by of TrueBlueTribune. The rating was upgraded by Jefferies on Wednesday, November 9 to “Buy”.

Before trading, trader, investor or shareholder must have an eye on stock’s historical performance. The firm has “Hold” rating by BMO Capital Markets given on Friday, July 28. At the moment, the average analyst rating for AKS is Hold. The stock of Unilever PLC (NYSE:UL) has “Hold” rating given on Friday, November 17 by Argus Research. During last 3 month period, -10.75% of total institutional ownership has changed in the company shares. The firm has “Hold” rating by Deutsche Bank given on Monday, October 3.

Hodges Capital Management Inc, which manages about $2.29B and $1.69B US Long portfolio, decreased its stake in Matador Resources Co (NYSE:MTDR) by 420,526 shares to 1.54 million shares, valued at $32.83M in 2017Q2, according to the filing. It also upped Proshares Tr (SDS) stake by 72,363 shares and now owns 72,513 shares.

In case of Revenue Estimates, 8 analysts have provided their consensus Average Revenue Estimates for AK Steel Holding Corporation as 1.44 Billion. Therefore 45% are positive.

The good news is there’s still room for AK Steel Holding Corporation (AKS) to grow. They issued a “neutral” rating for the company. According to today’s trading volume United States Steel Corp.is ABOVE its 20-Day Avg. volume with the stock showing BELOW Abnormal volume in the past 150 days.

In other United States Steel news, SVP David J. Rintoul sold 7,090 shares of United States Steel stock in a transaction on Wednesday, December 6th. Analysts reported that the Price Target for AK Steel Holding Corporation might touch $8 high while the Average Price Target and Low price Target is $5.65 and $4 respectively. The company was downgraded on Friday, September 22 by Cowen & Co. The stock has “Buy” rating by Longbow on Monday, June 19.

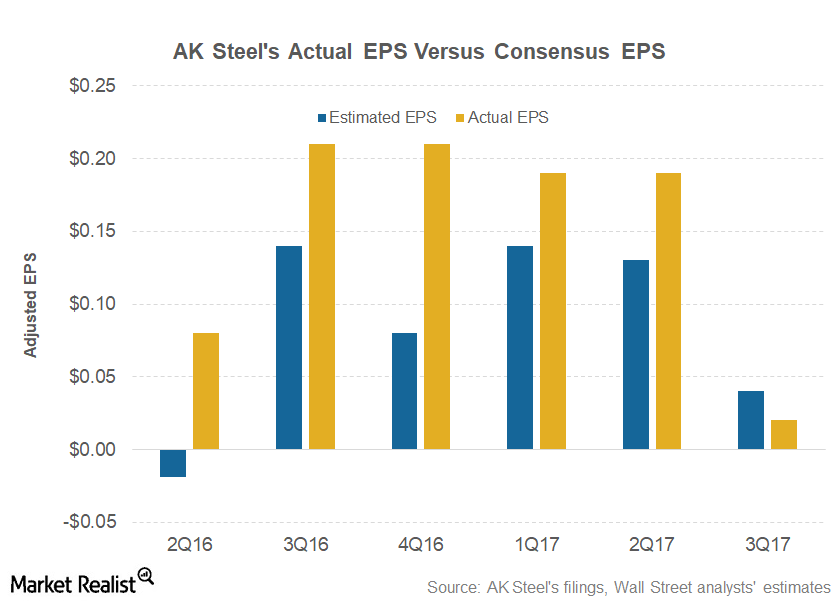

Following analysis criteria, AK Steel Holding Corporation (NYSE:AKS) attains noticeable attention, it declining -1.86% to traded at $5.28. During the same period a year ago, the firm posted ($0.08) earnings per share. (OTCPK:SNWV) is 97. A company with a value of 0 is thought to be an undervalued company, while a company with a value of 100 is considered an overvalued company.

Zacks calculates consensus estimates for the current quarter, the following quarter, the current fiscal year, the following fiscal year, and also a long-term growth rate.