Amazon will dominate the US apparel market by 2020

We expect a few upside to consensus revenue estimates from growth in Prime revenues driven by additional media options, same-day fulfilment options, higher average Prime pricing, and continued strong growth in AWS revenue during the quarter.

Besides the multifaceted prowess that Amazon displays across its businesses, one specific tactic that seems to be helping is that Amazon has changed its mind about becoming a luxury apparel retailer. Three investment analysts have rated the stock with a sell rating, eight have issued a hold rating and thirty-one have issued a buy rating to the company’s stock.

Cantor Fitzgerald analyst Youssef Squali, in a report Monday, maintained a buy rating on Amazon with a price target of 460.

Cowen’s data predicts that apparel sales on Amazon.com will reach $16 billion this year and over $52 billion by 2020. The firm at present has Buy rating on the stock. The 52-week high of the share price is $485.42 and the company has a market cap of $227,299 million. Analysts surveyed by Thomson Reuters expect the Seattle-based retailer to lose 14 cents a share on $22.37 billion in revenue. After a lackluster 2014 that was defined by a disappointing series of earnings misses, shares of the e-tailing giant are up 56% this year. (NYSE:EGY) soared $0.25 (or +18.12%) to $1.63 and 2,162,686 of its shares exchanged hands on Monday’s market activity as the company said that production at its Southeast Etame 2-H well was brought online at the rate of approx.

Amazon is seeing a wave of upgrades just days before it reports quarterly earnings.

The e-commerce company really expanded into the apparel market back in 2008 when Amazon hired Cathy Beaudoin from Gap Inc.

In other Amazon.com news broadcast, Director John Seely Brown bought 480 possesses of Amazon.com shares in a deal… The shares were sold at an average price of $420.61, for a total value of $1,261,830.00. Also, Director Alain Monie sold 3,000 shares of Amazon.com stock in a transaction that occurred on Friday, May 1st.

Amazon.com, Inc. (NASDAQ:AMZN) is an e-commerce company. The Company sells a range of products and services through its various owned and affiliated Websites.

It’s all about sales growthAmazon is a growth company, not only because the business is expanding rapidly, but also due to its strategy and capital allocation policy. The Company designs its websites to enable millions of products to be sold by the Company and by third parties across dozens of product categories.

Amazon now offers several brands typically found in department stores, such as Levi’s and Tommy Hilfiger.

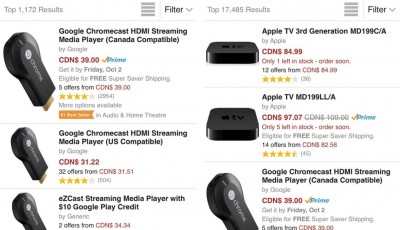

Amazon Prime is a crucial driver for Amazon, as Prime members are more loyal to the company and tend to spend more money on their purchases.