Arun Jaitley Launches Two Funds by SIDBI

The objective of SMILE scheme will be to provide soft loans in the nature of quasi-equity and term loans on relatively soft terms to MSMEs.

“The fund is expected to catalyse tens of thousands of crores of equity investment in start-ups and MSMEs”. Foreign capital was welcome, said Jayant Sinha, the minister of state for finance, but local venture capital needed to be strengthened to help finance start-ups other outside e-commerce.

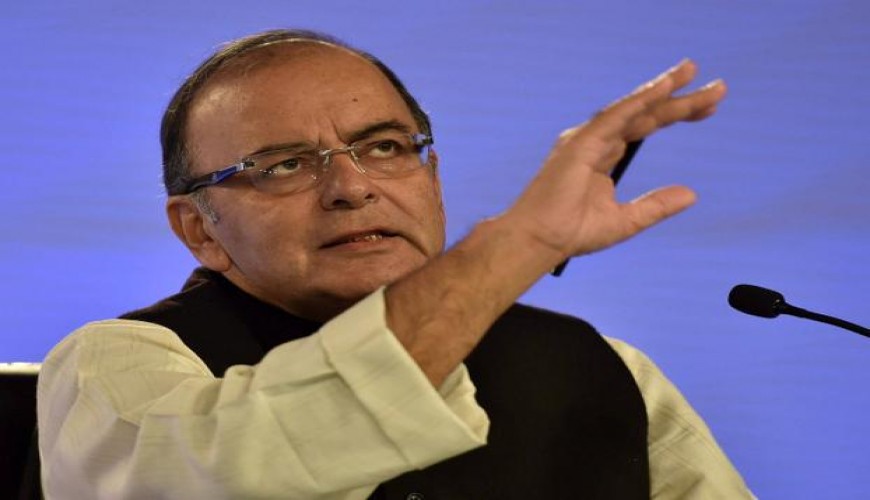

Lashing out at the “obstructionist politics”, Finance Minister Arun Jaitley on Tuesday said reforms were stalled during the recently concluded Monsoon Session of the Parliament at a time when there is an “almost unprecedented” urge for it by the people of the country.

“Various important initiatives taken by the government was sanguine that Make In India initiative with a conducive financial ecosystem will make India a manufacturing hub very soon”, the minister added.

“The mood for the government to take positive steps has never been so positive, as the kind we have seen in the last few days”, Jaitley said at a function in Delhi to launch a Fund of Funds for startups.

“And therefore, sector after sector which remained closed, we have to offer ourselves as a recipient of global investment, and that is the direction in which the present policy regime of the government has moved”, he said at the SBI Banking and Economics Conclave.

Speaking at the launch of Sidbi’s Fund of Funds, Sinha said a lot of foreign funds are coming in the venture capital space in the country. The fund has committed up to Rs 60 crore in IvyCap Ventures, up to Rs 30 crore for Blume Ventures and up to Rs 20 crore for Carpediem Capital Partners, sources told ET. We also need a domestic system which can fund start-ups.

“We need to strive for that”. “India is expected to surpass the UK in terms of number of startups launched and would be behind only to the US”.

“Through strengthening of public opinion, passing them as money Bills or having a joint session is how we can get the legislation required for reforms”, he said.

IAF is a Fund-of-funds managed by Sidbi and is intended to play a vital role in this financial ecosystem. India’s largest insurance company LIC will be a coinvestor in the IAF.