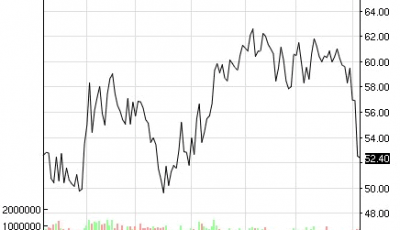

Baker Hughes rig count, July 2

Contrary to earlier, more optimistic projections, some analysts now think the price of USA crude will linger around $60 a barrel through the end of the year.

The number of oil drilling rigs in the US increased this week by 12 to reach 640 snapping a run of 29 consecutive weeks of declines.

Analysts expect the oil rig count to continue to rise over the latter half of this year, raising US crude supplies and pulling down oil prices.

There will be no floor trading Friday because of the Fourth of July holiday in the USA, and transactions will be booked Monday for settlement purposes. It was the 1st weekly increase since December 5.

“One swallow doesn’t make a summer”, said analysts at Commerzbank.

Crude oil prices nudged higher Thursday morning ahead of a pivotal United States jobs report that may shed light on when the Federal Reserve will raise interest rate.

There are risks that could cause a pullback, like high USA inventory levels, greater Saudi production and a surge in USA shale production.

However, the bank said the drop would prove shallow, owing to productivity gains, which would leave the market oversupplied during the first six months of 2016 by as much as 2.3 million barrels per day.

A final agreement to curb Iran’s nuclear program is expected to pave the way for the lifting of Western sanctions and release more Iranian crude on the oversupplied global market.

Iran rejects allegations that it has been seeking to develop nuclear arms, and has resisted moves to give the worldwide Atomic Energy Agency unbridled access to sensitive military sites to verify its claims.

Oil markets took a hit on Monday as investors anxious a Greek debt default and the possible departure of Greece from the euro zone could hit growth in Europe and squeeze fuel demand. Traders have been watching the rig counts as they try to determine when US oil production will fall.