Bank of England member warns of low interest rates risk

But CPI was held back by the ongoing supermarket price war, with a 2.7% year-on-year fall in the price of food and non-alcoholic beverages. Shops such as Next and Clarks always cut prices in July, but this year the fall was smaller than in 2014.

That said these deflationary pressures are being offset by the increase in our spending power – with wages significantly outstripping prices rise – which is encouraging us to buy a bit more.

This is contrary to market expectations, with the majority of analysts predicting that inflation would remain at 0 per cent in July, as it was in June. “Overall, it is true to say that these figures are well in line with expectations and it looks as though the retail landscape is remaining steady”.

Britain’s inflation rate unexpectedly rose in July and a core measure of price growth jumped to the highest in five months.

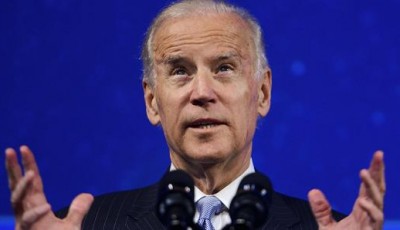

“With such low inflation today it is understandable to want to avoid pre-emptively ending this holiday”, Forbes said.

His comments come just days after fellow MPC member Prof Kristin Forbes warned that waiting too long to raise interest rates risked undermining the UK’s recovery.

Sterling rose as financial markets weighed the likely timing of the first rise in UK base rates from their record low of 0.5 per cent in the wake of the stronger-than-forecast inflation data.

Services inflation, a proxy for domestic price growth, hit to 2.4pc in July, the fastest in four months.

According to Samuel Tombs at Capital Economics, the soaring inflation rates can taken care of until the second quarter of next year, as for inflation, there are chances that will turn to negative during the next couple of months.

“If inflation rises in the wake of the wage settlements, as is forecast, the MPC will have to raise interest rates still further to bring inflation back to target over the medium term”, the central bank said in a statement.

Mr Chester added that while the Bank of England is unlikely to read too much into one month’s data, the pick-up in the core rate is a timely reminder that not all indicators of inflation are pointing south.

Oil prices have halved since last summer and the prospect of sanctions being lifted against oil-producing Iran, adding to the glut in supply, has wiped out a recovery earlier this year to leave the price of Brent crude at below 50 US dollars a barrel.