Barclays set to name ex-JPMorgan banker Staley as new CEO – FT

Barclays is close to naming James Staley, former JPMorgan investment banker, as its new chief executive officer, with a few critics fearing the appointment would herald a return to a more ostentatious style.

Barclays has told regulators that Staley is the frontrunner for the CEO post, and if approved, the appointment could be announced within two weeks, said the person with knowledge of the situation, who asked not to be identified because the decision isn’t final. Staley left JPMorgan in early 2013 after serving the bank for 34 years.

Barclays is over a year into a plan to cut its reliance on its investment bank, which generates around a third of its revenue. He also has global clout, as a member of an advisory committee to the Federal Reserve Bank of New York.

But Mr McFarlane was approached by other board members who said that Mr Jenkins’ time had passed. The hedge fund bet against JP Morgan in the large derivative trade amassed in early 2012 by a trader for the bank nicknamed the “London whale”, at one point scoring gains of around $30 million, according to people familiar with the trades.

The U.K.-based bank has been searching for a new CEO since June, when it sacked Antony Jenkins.

Experts at Deutsche Bank said: ‘The appointment of Jes Staley will be seen by the market as giving a re-commitment to the investment bank after moves to reduce the emphasis on this division under former chief Antony Jenkins.

Given Staley’s background in investment banking – alongside the widespread view that his predecessor was ousted over his retail expertise – one potential avenue is a revamping of Barclays Capital, the firm’s investment banking business.

“Winding down an investment bank with a big American investment banker in charge of the group is going to be challenging”, the person said.

It also comes as numerous biggest banks in Europe and the United Kingdom grapple with how to make money in investment banking under exacting regulation while staving off competition from USA rivals. He worked his way up the ladder over more than three decades at JP Morgan, rising to run its asset-management unit before taking over the reins of JP Morgan’s investment bank in 2009.

Late Tuesday, the bank issued a statement saying the process of appointing a new chief executive “has not yet concluded and Barclays will provide a further update once that is complete”.

Barclays will soon be appointing a new chief executive, it has emerged.

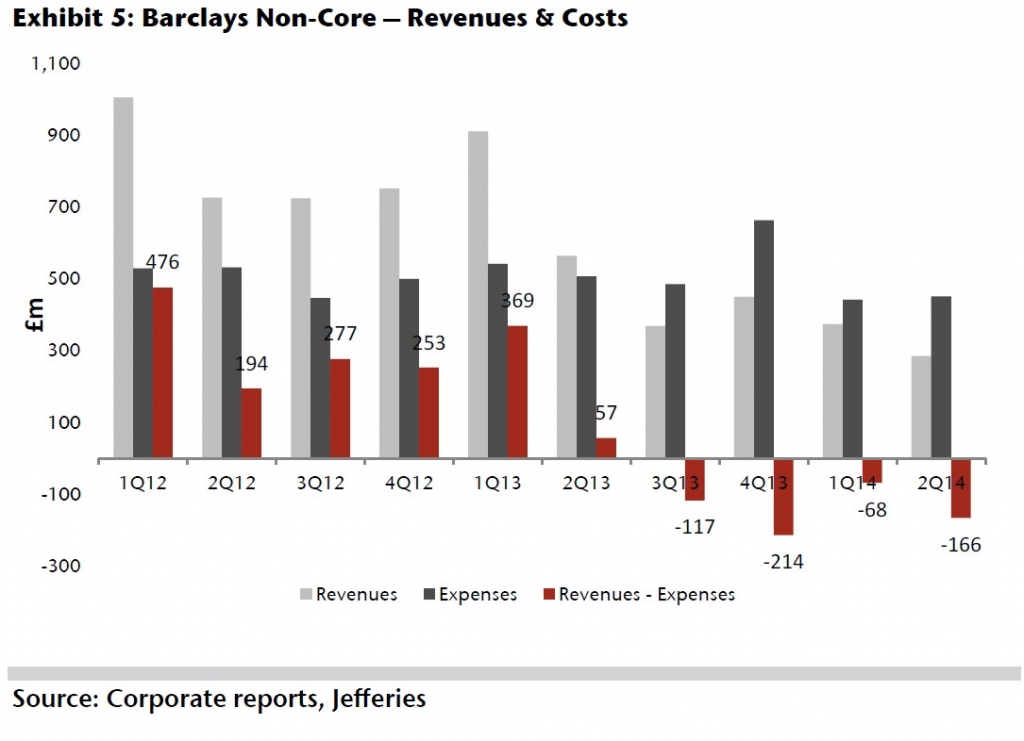

With low profitability and high costs, Barclays’ restructuring carries a lot of execution risk.

But he said Barclays and other banks lack scale in wealth management, and the main benefit from the business is the liquidity and funding they get from deposits rather than from profits. But after Mr Diamond’s departure, it would have been very hard for Barclays to have chosen anyone other than a retail banker like Mr Jenkins.