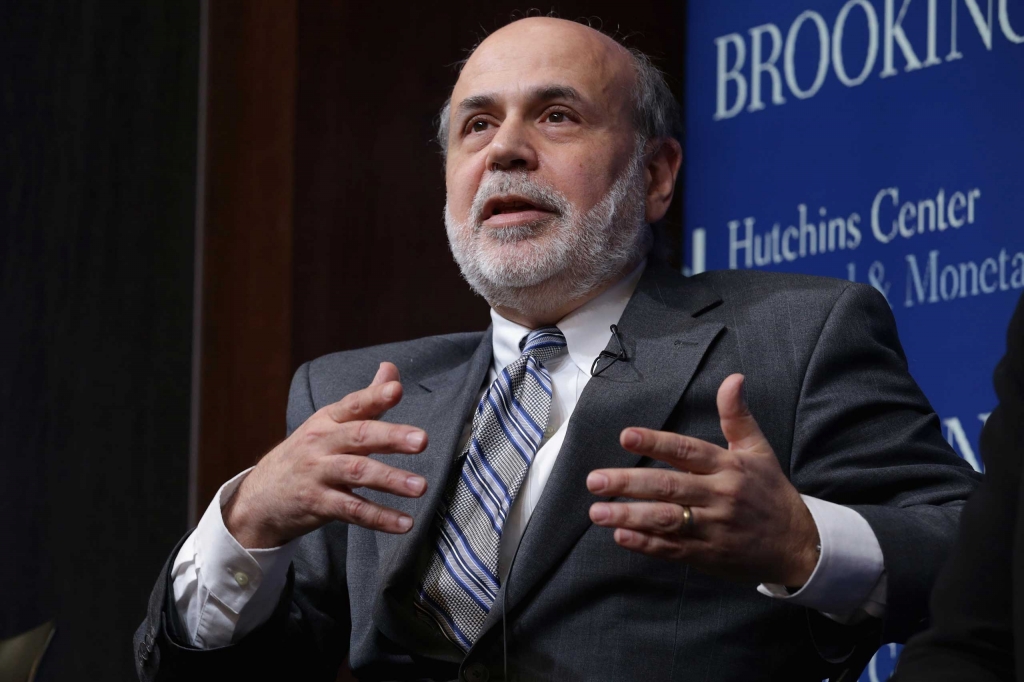

Ben Bernanke: More execs should have faced prosecution for 2008 crisis

There is something else that happened over the weekend that received little attention as everyone was talking about Ben Bernanke’s new book and how he thinks more executives should have gone to jail for causing Great Recession. Now a financial firm is of course a legal fiction; it’s not a person.

Mr Bernanke said “everything that went wrong or was illegal was done by a few individual, not by an abstract firm”. It is supposed to detail life inside the Fed during the worst crisis since the Great Depression.

But Bernanke ends his comment by stating “monetary policy can no longer be the only game in town”, and here is where I both agree and disagree with him.

In the interview, Bernanke said he wished that Lehman Brothers, which almost became a synonym for the crisis, could have been saved.

Bernanke explained that the Fed did not have the authority to jail anyone.

“A Memoir of a Crisis and its Aftermath”, the Fed chairman from 2006 to 2014 recounts key moments involving Wachovia and hometown rival Bank of America.

Growth has been slower around the world, but the USA economy has been doing better than others, Bernanke said.

“Even today, there’s still a lot of people who, I think, misunderstand what we did and why we did it… there’s still hostility toward the Federal Reserve, politically”.

In many cases, the new book offers a defense of what the Fed did and did not do at the time.

Bernanke said he would not second-guess Fed Chairwoman Janet Yellen, saying only that his successor faced “tough” calls. He says he and the Treasury secretaries he worked with, Henry Paulson followed by Timothy Geithner, all shared the view that the practical aspects of shoring up the economy were more important than the “political considerations” pointing toward punishment of individual wrongdoers.

Bernanke also said he understood the frustration over the massive bailouts of the financial sector. The 5.1% headline unemployment rate would suggest that the labor market is close to normal. The benefits of growth aren’t shared equally, and as a result many Americans have seen little improvement in living standards.

What’s clear about the post-Fed Bernanke is that he found criticisms of his Fed stinging and still feels the barbs.

Bernanke, who grew up in rural South Carolina, rejects any notion that he wanted to bail out Wall Street. The implication is that Fuld’s blindness to reality prevented an orderly sale of Lehman, which might have averted the worst of the crisis.

“I certainly was not eager to bail out Wall Street”, Bernanke said.