Berkshire Hathaway reports steep drop in profits

Companywide, revenue climbed climbed 3.2% to $51.4 billion, with $5.4 billion from Burlington Northern, the railroad that Buffett bought in 2010 as an “all-in” bet on the U.S. economy.

The conglomerate reported operating earnings per Class A share of $2,367 per share in the second quarter, missing expectations for earnings of $3,038, according to estimates from Bloomberg.

The gain hasn’t reversed Berkshire’s stock slump this year.

Accounting rules require Berkshire to report investment and derivative gains and losses with earnings. “Overall, our average train speeds and our on-time performance in 2015 improved considerably over 2014”, Berkshire said in the filing.

The insurance segment posted an underwriting loss of US$38 million, compared with a gain of US$411 million a year earlier. Its pretax underwriting gain fell 87 percent to $53 million as it paid out more of the premiums it collected to cover losses. In June, Insurance Australia Group Ltd. agreed to cede a fifth of its premiums and risk to Berkshire, as part of a decade-long tie-up. In May, he said the prospects for that business had “turned for the worse” as hedge funds and other investors piled into the industry, driving down the price of coverage.

Berkshire’s BNSF railroad generated $963 million net income, up from $916 a year ago, despite relatively flat volume and weaker demand for coal and crude oil shipments. In the same period a year earlier the business had posted a $411 million after-tax profit.

Berkshire has more than 80 operating businesses in such sectors as insurance, energy, food, industrial products and railroads.

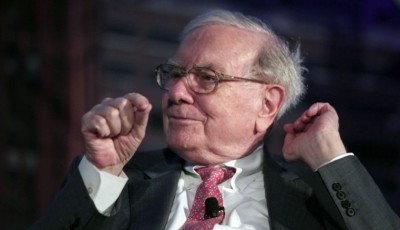

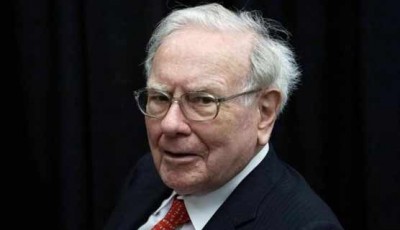

Mr. Buffett’s latest coup, a tie-up of H.J. Heinz Co. and Kraft Foods Group Inc., which he helped engineer with Brazilian private-equity firm 3G Capital Partners, rendered Berkshire the largest shareholder in the resulting Kraft Heinz Co.

Berkshire’s cash pile has been growing in recent quarters and stood at a record $63.7-billion at the end of March. But Berkshire said it expects to record a $7 billion gain on the Kraft deal in the third quarter.

The company also has dozens of smaller businesses that sell, among other things, Benjamin Moore paint, Borsheim’s jewelry, Dairy Queen ice cream, Fruit of the Loom underwear, Johns Manville insulation and See’s sweets.

Berkshire Hathaway Class A shares now trade at around $US215,000 per share; Class B shares trade at 1/1,500 the price, or around $US143. The shares are about 6 percent below their record highs set on December 8.