Berkshire Reports $4.5 Bln Stake In Refiner Phillips 66

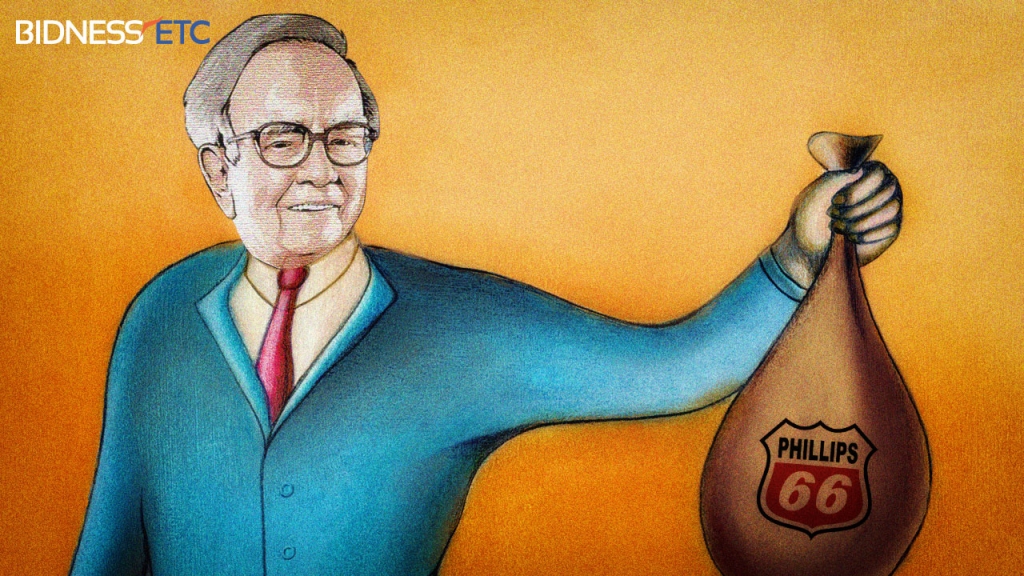

On Friday evening, billionaire investor Warren Buffett, the founder of Berkshire Hathaway, disclosed that he had purchased a massive stake in oil refinery Phillips 66 (PSX).

The 57.98 million-share, or roughly 10.8 percent, stake was revealed in a Friday night filing with the U.S. Securities and Exchange Commission.

Mr. Buffet is known for his long-term bets when companies are facing potential undervaluation. “They seem to be taking the long view that demand for fuel is going to come back”. Berkshire may have begun rebuilding its Phillips 66 stake in the second quarter, when it bought $3.09 billion of equities overall.

Still, Berkshire may have been accumulating the stake for some time, given the scale of the holding, said Gallant.

Earlier in August, Berkshire said it had omitted some information in public filings, but it had been conveyed to regulators confidentially.

The new investment is up sharply from Berkshire’s last disclosure.

He did this in 2013, when Berkshire amassed a $3.45 billion stake in Exxon Mobil Corp.

To help put Buffett’s life and accomplishments into perspective, our staff has put together a handy visual guide that includes key statistics and the company’s biggest investments.

Crude oil costs have since fallen by greater than half, although Phillips 66’s share worth has dropped by lower than 1 %. Analysts across the Street are largely positive on Phillips 66 stock. It is the top shareholder in Coca-Cola Co., IBM and American Express Co.