Bitcoin’s fraud perception will change over time: Cboe CEO Ed Tilly

Yesterday, the Bitcoin derivative contract expiring in January 2018 changed hands at ,740, which is a premium of more than $2,000 compared to the spot market.

The story is similar for litecoin, which was trading down 1.08 percent to $97 at midday.

If this is right, one could infer that holders of large number of Bitcoins can coordinate among themselves to prop up the market.

But as bitcoin set a new record, digital currency exchange operators Coinbase and Bitfinex reported problems with service through their websites on Tuesday, frustrating traders seeking to cash in on the latest surge in the value of bitcoin and other cryptocurrencies. And regular people who aren’t too big to fail usually end up taking the brunt of a downturn.

The vast amount of trades to-date have been long positions, with those looking to take short positions challenged by the inherent difficulties that have persisted in going against the grain.

The ETF industry has seen explosive growth in terms of both AUM and launches thanks to unique strategies, creativity, transparency, diversification benefits, enhanced tax competences, low turnover and low cost.

Bluebird Bio shares rose 11.13 percent after its experimental gene-modifying immunotherapy drug co-developed with Celgene received positive responses in early stage study. No representation is being made that any account has in the past, or will in the future, achieve profits using these recommendations.

In China, officials voiced strong dissatisfaction over the EU’s new anti-dumping legal framework that only requires companies and industry groups to prove “significant market distortion” when filing anti-dumping cases. It’s hard to say what bitcoin’s price will do next, considering the price was breaking symbolic barriers every few hours for a while last week. Ethereum Classic also climbed more than 10%. The coin had lost about $16 in a downfall from 5 AM to reach $423 at 8 AM before surging back. “With the current gravity-defying bullish momentum, it may be no surprise if bitcoin concludes 2017 on $20,000”. This means they aren’t actually buying and selling off their own currency, simply betting on how much its value will increase or decrease.

“CME, CBOE, and NASDAQ all announced the launch of futures markets for bitcoin, and many see this as further legitimization of bitcoin as a new asset class”. Somebody who invested $1,000 in bitcoin at the start of 2013 would now be sitting on around $1.2 million.

-CME will apply price limits, also known as circuit breakers, to its bitcoin futures of 7 percent, 13 percent, and 20 percent to the futures fixing price. “Just as one couldn’t rule out 5K, then 10K, one can’t rule out 100K”, he said.

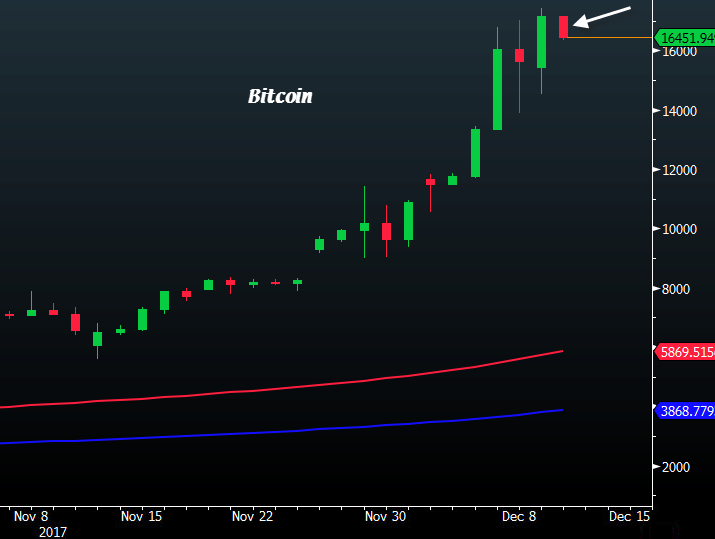

The price topped $16,750 around the same time that noted economist and hedge fund manager Nassim Taleb suggested that Bitcoin could hit $100,000. This article is strictly for informational purposes only. As for the bitcoin, it has gone above the 20 days moving average of $10,815.06.