Britain revises down its economy forecast in 2015

The trouble is that the living wage is now £7.85 an hour outside London, and £9.15 an hour in London.

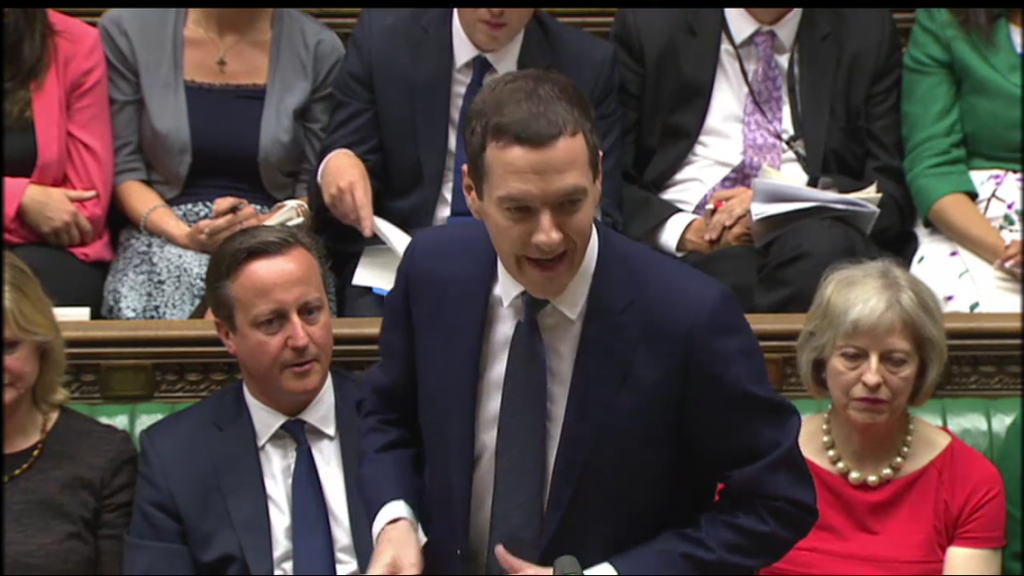

Osborne insisted that his deal on the minimum wage rise coupled with cuts to tax credits would make a family with one full-time earner on the minimum wage better off.

Automatic entitlement to housing benefit for jobless 18- to 21-year-olds will be scrapped. Richard Stone, Chief Executive of The Share Centre, explains: “For higher-rate tax payers, or those with more substantial portfolios this will be a potentially painful tax increase”.

Rate of Employment and Support Allowance aligned with Jobseekers’ Allowance for new claimants deemed able to work.

He added businesses would be taxed less in exchange and some are already taking a “free ride”.

There was also concern that the rise in the minimum wage would encourage European Union migration to the United Kingdom and undermine the goal of David Cameron’s key European Union renegotiation objective – giving Britain the right to bar European Union migrants from receiving tax credits for four years.

In a step that will intensify fury over plans to give MPs an 11% pay rise this year, public sector employees now face four more years with increases capped at 1%.

“I was delighted to see the introduction of the new National Living Wage coupled with tax cuts for working families”.

Forecast for paying down the national deficit and running a surplus knocked back by a year from 2017/18 to 2018/19.

As Labour struggled to calibrate an effective response – accepting the principle of the reforms but opposing the way in which they are implemented – the chancellor claimed his budget represented a “new settlement” with Britain.

Social rent payments will be cut 1 per cent every year until 2019.

Will budget consultation on pensions tax relief spell the end of salary sacrifice?

The OBR also suggests that changes to inheritance tax will discourage elderly people form selling their homes as “the tax disincentives to hold on to a property until death have fallen”. The Chancellor has also committed to the North Atlantic Treaty Organisation target of spending two per cent of GDP on defence for the next decade.

Vehicle Excise Duty will be re-introduced for all new cars, with varied costs based on environmental friendliness. The change, predicted by The Independent last week, will affect new claimants from 2017 but not existing ones.

NHS will receive a further £8bn, £10bn more in real terms by 2020.

Promising a new “higher wage, lower tax, lower welfare” Britain, the Chancellor said six million people would see their pay increase as a result of the plan – and those now earning the minimum wage of £6.50 an hour will be £5,000 better off by 2020, he claimed.

Mr Osborne wanted to set out a Conservative vision for helping working people.

However, union leaders were quick to attack the Budget, describing it as a “beautifully crafted con trick”.

“It says to people we’ll make sure you’re going to get a proper wage, a national living wage, but there are going to be less benefits”. He confirms what GMB has being saying for some time – the vast majority of employers can afford pay rises and no amount of howling from the CBI will alter that fact.

“Just about everyone I know has been affected in one way or the other”, said protester Helen, 53.

Scottish Green Party Co-convenor, Patrick Harvie MSP, slammed most of the measures.

“The hopes of millions of working people are more important”, Ms Harman said. Demonstrators included activists and supporters of Disabled People Against the Cuts, reported The Guardian.