Bumper tax receipts push July public finances to £1.3bn surplus

The UK government spent less last month than it received in taxes and other forms of income, official figures have shown.

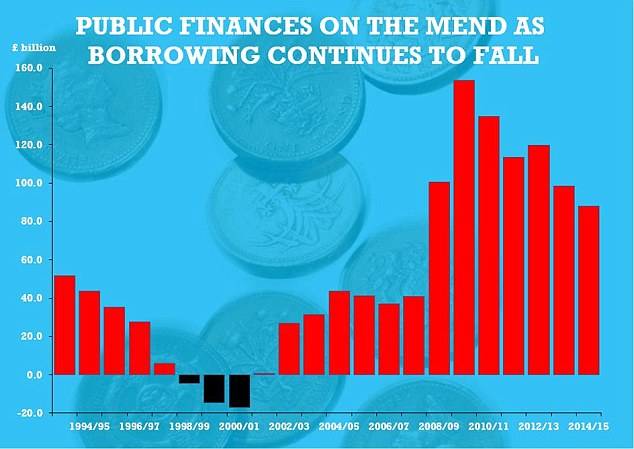

The surplus – excluding the effect of bank bailouts – stood at £1.3 billion last month, lower than expected but still a reversal compared to borrowing of £100 million for the same period in 2014.

Public finances have traditionally been in surplus in July, but tepid wage growth in the previous two years depressed the usual surge in payments from individuals filing self-assessed income tax returns. The ONS said income tax receipts of £18.5bn were the strongest for a July since records began in 1997 and compared with £17.6bn a year earlier. They stated: “July’s figure means that borrowing in the first four months of the fiscal year of £24bn was 24% lower than the £31.4bn seen last year – a bigger drop than the 21% the OBR expects to see for the year as a whole”.

Treasury coffers were boosted after seeing the best July for income tax related receipts, generating £18.5billion in revenues. But with debt over 80 per cent of GDP, the job is not done’.

Osborne said the latest figures were testimony to the economic recovery but that the government would continue to work on cutting Britain’s deficit.

British finance minister George Osborne said last month that he was aiming to bring down the budget deficit in the current financial year to 69.5 billion pounds, or 3.7 percent of economic output.

“If this trend persists over the remaining eight months of the fiscal year, this year’s deficit would be 67 billion pounds”, Samuel Tombs, economist at Capital Economics said.

Public sector net debt, excluding state-controlled banks, was 1.505 trillion pounds in June, equivalent to 80.8 percent of GDP.

“There are eight months of the fiscal year to go and revisions to estimates of borrowing in the early months of the year are often large”. VAT and corporation tax receipts were also up.