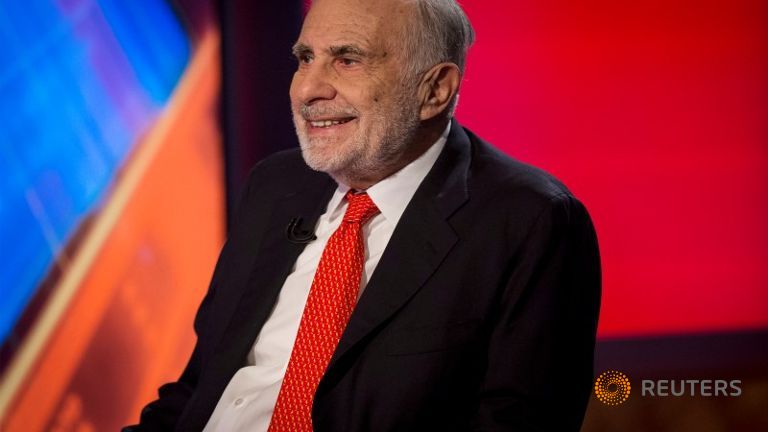

Carl Icahn has acquired a 7% stake in Xerox

Activist investor Carl Icahn turned up the pressure on American global Group to separate into three public companies.

Earlier this month during an interview on FOX Business Network’s Mornings With Maria Icahn said, “AIG would be much better off taking this company and splitting it into 3 or 4 parts or selling a lot of the divisions that they have”. Hancock, who became CEO past year, has said AIG benefits from having a diversity of operations and that separating into three would be harder than Icahn thinks because of hurdles from regulators and credit-rating firms. In a statement on Monday, he said that he has met with Hancock to discuss the issue on more than one occasion. It was reasoned at the time that the collapse of AIG would have a cascading effect, dragging down other companies entangled in the growing financial crisis.

AIG representatives did not immediately comment Monday morning.

Carl Icahn has disclosed a 7.13% stake (72.2M shares) in Xerox (NYSE:XRX), and says he plans to hold talks with management. “In addition, in those conversations he failed to lay out any alternative strategic plan with the potential to unlock value for shareholders or to provide compelling reasons as to why these businesses belong together”, the statement read.

The USA bailed out AIG at a cost of $85 billion, money the company has since repaid.

Xerox stocks, which have fallen over 22 per cent over the year, rallied gamely on the news, to trade at $10.75 in after-hours trading.

Icahn cited in his October letter the support of billionaire hedge fund manager John Paulson, who also is among the largest holders of AIG.