Cash shortage: Govt might take 3 days to restore cash

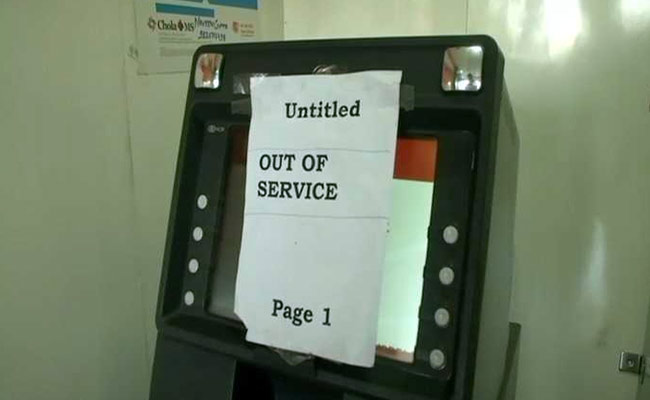

People have to visit several ATMs to avail cash but they found ‘No cash ‘notice out of the ATM.

“Overall, there is more than adequate currency in circulation and also available with the banks”.

Many have tweeted about not getting cash at ATMs in Delhi too, in a reminder of long queues and non-functioning machines after demonetization in November 2016. Garg noted that there is also a perception that there may be shortage of currency in the future. That’s the question we’re asking this evening on Livestream. This is a nationwide issue and it is out of the state government’s purview. So just where has the cash gone?

In Hyderabad itself, news agency ANI quoted people saying that they were not able to withdraw cash since few days.

Puneet Sharma, a Lucknow trader compared the situation to that after the government announced demonetisation in November 2016. The situation has been the same for last 15 days. But we are not in panic mode. “The bank does not allow withdrawals beyond Rs 10,000”. “There is no restriction on branch withdrawals yet”.

The state finance minister had on Monday acknowledged that banks were facing cash crunch and he had asked the RBI to address the problem. However, the remaining new generation banks are operating with enough cash. In a month, supply would be about Rs 70,000-Rs 75,000 crore.

A few were not convinced with Jaitley’s statement that there is no shortage. Coimbatore has 2,100 ATMs, of which 1,000 ATMs are situated in the city and almost 65 per cent of the ATMs are administered by nationalised banks. “It’ll be done in three days”, Shukla said. “We still have a reserve of Rs 1.75 lakh crore”. But that should result in shortage of cash across the country, not in some states.

The situation was same at Halvad APMC, one of the largest wholesale markets of cumin seeds and cotton in Saurashtra region. In next couple of days, we’ll have supply of about 2500 cr of Rs 500 notes per day. Local bank managers don’t have specific answers for the cash shortage.

Rural areas are the worst affected and farmers are not being paid in full for their produce. “You can assume this is one note most suitable for people to keep themselves”, Garg said adding that there is no need to print more of these notes.

Congress president Rahul Gandhi while attacking the government said that “terror of note ban” has once again gripped the nation.

SBI Chairman Rajnish Kumar also stepped in to allay fears, telling a TV channel that “there has been adequate supply of currency from the RBI”. “Since the GST was implemented, we shifted to cheque and electronic transfer mode of payment”. He alleged a “conspiracy” to create a shortage of cash in the state, where assembly elections will be held later this year, by keeping the highest denomination notes out of circulation. The same report by RBI shows that as on 23 February, total currency in circulation was Rs 17.82 lakh crore, or 99.17% of pre-demonetisation levels of Rs 17.97 lakh crore.