Chancellor announces “Living Wage” for 2020

Small businesses warned it would lead to reduced hours and staff lay-offs as many would not benefit from the corporation tax drop and other tax incentives offered to offset the extra costs.

Mr Osborne has denied Labour claims that his package was “pulling the rug” from underneath thousands of families, insisting it was vital both to continue reducing the “simply unsustainable” welfare bill and to tackle the UK’s “low pay problem”.

The trouble is that the living wage is now £7.85 an hour outside London, and £9.15 an hour in London.

Britain’s Treasury chief pledged Wednesday to crack down on tax avoidance and evasion as he delivered the first budget put forward by an all-Conservative government in almost two decades.

“I am offering economic security to the country”.

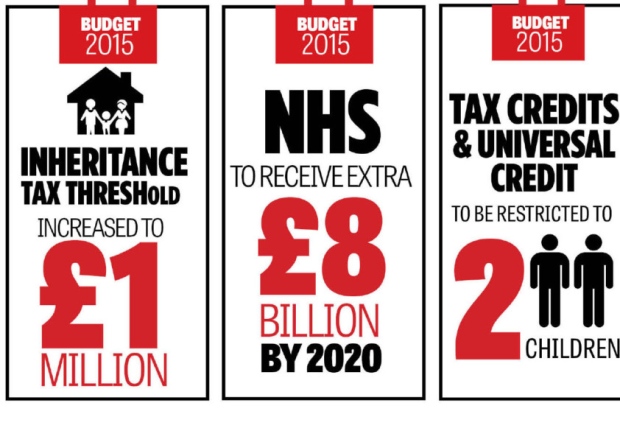

Mr Osborne said the OBR predicted only a “fractional” impact of jobs, with overall employment still forecast to rise by one million by 2020. Nine out of 10 families qualified for the state top-ups introduced by Gordon Brown when he was Labour’s Chancellor. Firstly, the amount that a home owner can receive tax free for letting a room in their main residence will be increased to £7,500 in April 2015 from the current level of £4,250.

He added: “It’s a budget that recognises the hard work and sacrifices of the British people over the last five years”.

The Chancellor said he wanted to take Britain “from a low wage, high tax, high welfare economy, to a higher wage, lower tax, lower welfare country”.

But Mr Leslie said the Treasury’s hope on the figures was that “maybe if you stand on one leg and squint a little bit people won’t notice this difference”.

“That is a regressive indicator of the first Conservative Budget in 20 years, where people in vulnerable situations in our society, on low incomes, have just been punished by a Conservative Government”.

The Institute for Fiscal Studies said that three million families will also lose an average of £1,000 each as a result of changes to the benefits system. That includes axing child tax credit and housing benefits for families who have more than two children as well as for those under 21.

At the same time Mr Osborne slashed £12bn form the welfare budget targeting tax credits and working age benefits.

Automatic entitlement to housing benefit for jobless 18- to 21-year-olds will be scrapped. And university maintenance grants will be replaced with loans.

In a step that will intensify fury over plans to give MPs an 11% pay rise this year, public sector employees now face four more years with increases capped at 1%.

Osborne also said a levy on banks would be gradually reduced over the next six years, while a new eight per cent surcharge on bank profits will be introduced beginning in January 2016.

Tristan Watkins, United Kingdom country manager for BNP Paribas Leasing Solutions said: “While the Chancellor has clearly listened to the warnings that the original plan of cutting the AIA to £25,000 was not wise, there will still be some disappointment that the new level has not been set higher”.

The Living Wage Foundation welcomed the increase to minimum pay, but noted several concerns including how the policy would interact with tax credits and other elements.

“This is the new settlement. That is the new settlement and I think it is the new centre of British politics”.

Mr Osborne declared: “Britain deserves a pay rise and Britain is getting a pay rise”.

“The United Kingdom is already one of the most unequal countries in the world”. How can you make that claim when you are making working people worse off.