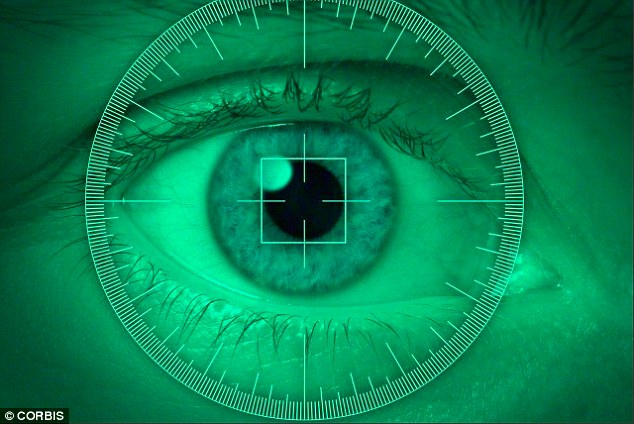

Citigroup Unveils Eye-Scanning ATM

The high-tech system will be an alternative for the plastic cards.

But what if there are no more cards?

The innovative technology will be implemented by Citigroup Inc.in conjunction with Diebold Inc., a company which provides self-service and ATM (automated teller machine) solutions.

Access to money is granted using mobile banking methods, which include NFC, biometric iris scans and quick response codes.

The Wall St Journal reported that Citigroup had not set a date for when the retina scanners would be introduced.

A customer uses a traditional ATM at a Citigroup Inc. “They are looking to see what customer acceptance is around biometrics, to see where acceptance of biometrics is in the US population and around the globe”. The machine will be tested by Citigroup in New York. The machine, which connects to the mobile app, would spit out the right amount of cash. It appears that Citigroup has already begun trial-testing a brand-new “Irving” model, which is based on Diebold’s “Responsive Banking Concept” revealed previous year.

They are acting because in the USA credit scoring firm FICO said that in May the number of attacks on debit cards used at ATMs had reached its highest level in 20 years.

There’s the classic your card is physically stolen from your purse or wallet. J.P. Morgan is evaluating the use of voice- and facial-recognition technology.

A common tactic is distraction, with criminals engaging people in conversation just as their card is being taken out, allowing them to steal it.