Copper Sinks to Six-Year Low on China Demand Fears

Measures by the Chinese government aimed at stabilizing the equities market are failing to stop a selloff that erased more than $3.2 trillion of value in less than a month. “Concerns about Chinese growth and uncertainties related to the equity market correction are keeping metals under pressure”, said Carsten Menke, commodities research analyst at Julius Baer.

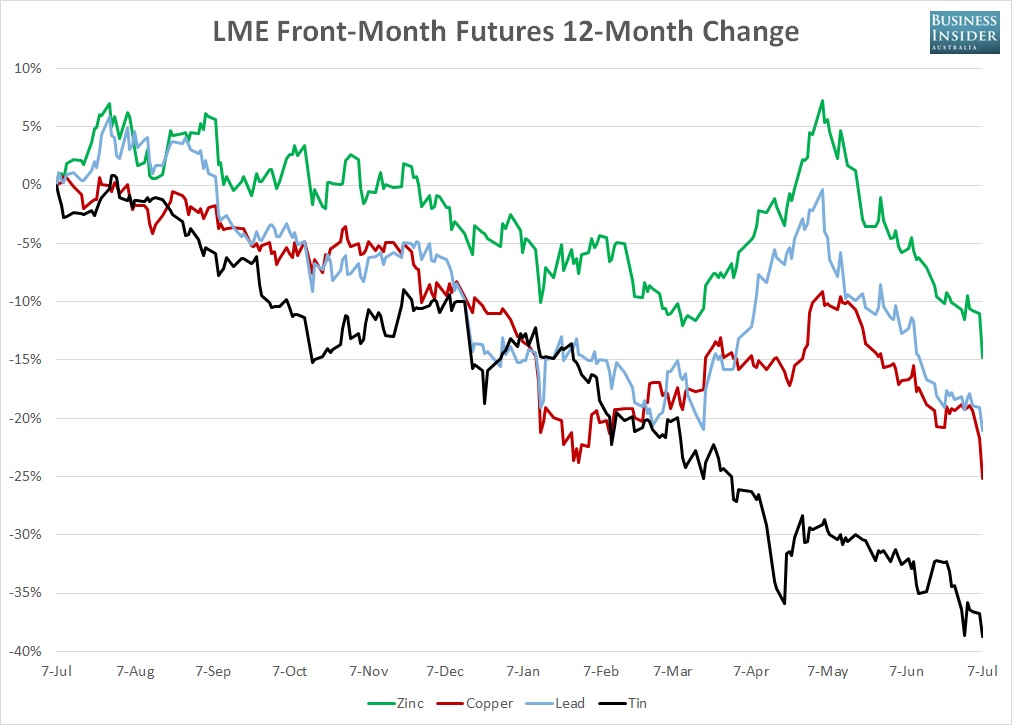

Aluminium touched a six-year low at $US1,641 and zinc hit $US1,925, its lowest since December 2013.

Greece overwhelmingly rejected conditions of a rescue package from creditors on Sunday, throwing the country’s euro zone membership into further doubt. “After the significant moves we saw yesterday, inevitably there is profit-taking”, said Nicholas Snowdon, metals analyst at Standard Chartered. Aggregate trading was more than double the 100-day average for this time, according to data compiled by Bloomberg. The base metal has been in a strong downtrend over the last month and has been forming lower lows and lower highs which is indicative of the fact that bears are in total control at the current moment. “The movement of Chinese A-shares will be decisive, copper prices may dip to a low seen early this year should stock…”

China is the world’s top copper consumer, accounting for roughly 40% of global copper demand, and its economic health is often directly reflected in the price of metal. Refined output is poised to exceed demand this year and next, Societe Generale SA estimates. LME copper three month rolling contract also declined by 164 point to $5565 per MT. Lead lost 2.5 percent to $1,722 a ton, more than 20 percent below a closing high of $2,157 on May 5. It’s the biggest such decline since December 2011. But limiting losses in copper was news that large copper smelters in China have lowered their minimum treatment charges for spot concentrate imports in the third quarter by 10 per cent due to falling global supply.