Crude oil gains on inventory news

An increase in Iranian crude oil production of around 600,000 barrels per day is likely in the latter half of next year, a U.S. federal report found.

According to the EIA, U.S. commercial crude oil inventories decreased by 1.7 million barrels from the previous week.

While traders said early signs of falling U.S. oil production had been supportive for prices, the problems that took out BP’s 165,000-barrels-per-day Whiting, Indiana refinery raised concerns that the U.S. oil storage hub at Cushing, Oklahoma could fill.

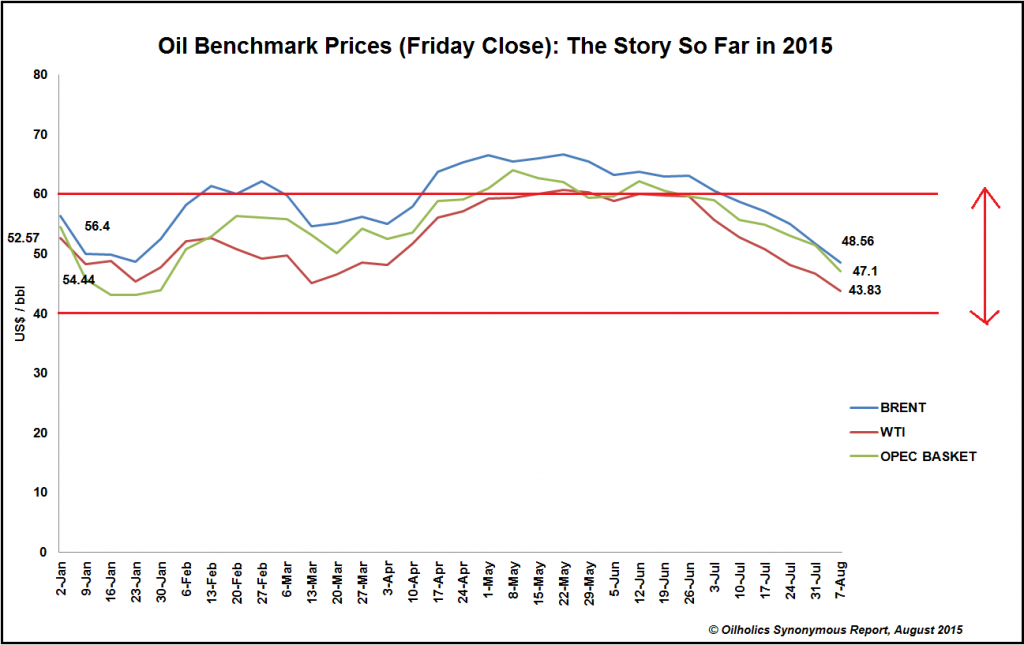

US benchmark West Texas Intermediate for September delivery turned higher in afternoon trade, rising 10 cents to $43.40.

US oil prices tumbled more than 3% to a 6-1/2-year low under US$42 a barrel yesterday as data showing a big rise in key US stockpiles intensified concerns over a growing global glut.

Brent crude for September, which expires Friday, eased two cents to United States dollars 49.20.

WTI had sank to its lowest close since March 2009 on Tuesday, while Brent also fell in London trade, after the central bank of China moved to devalue its national currency, yuan, by almost 2 percent against the US dollar.

This is going to be a big advantage for vehicle owners, drivers, shippers and airlines that enjoy the lower fuel prices due to the fall on the crude oil’s price while the oil industry is getting lower profits forcing them to cut down on expenditures and employment.

“The (yuan) devaluation has been important for commodity markets and we believe it signals that global macro conditions have changed”, Goldman Sachs said in a note to clients.

U.S. oil companies added more oil rigs this week despite the plunge in crude prices, marking the fourth straight week of an uptick in the rig count.

The IEA said during its monthly report that it was sharply raising its outlook for growth in demand for 2015 and 2015, and it was expecting supply growth from non-OPEC suppliers to decline in the coming year, with producers in the U.S. hit the hardest.

While output growth from countries outside OPEC has shrunk from 2014 highs and contributed to the 600,000 barrels a day fall in global supply in July, the IEA said, it is still running at about 1.2 million barrels a day above 2014 levels so far this year.