Crude oil holds at 7-yr lows as global glut persists

US weather forecasts call for warmer-than-normal temperatures through Christmas that would curb heating demand, boosting USA gasoline futures higher than heating oil prices in December for the first time in at least five years.

This outcome happened on Thursday a few days after Federal government proposed $38 per barrel as the oil benchmark price for the 2016 budget, down from $53 this year.

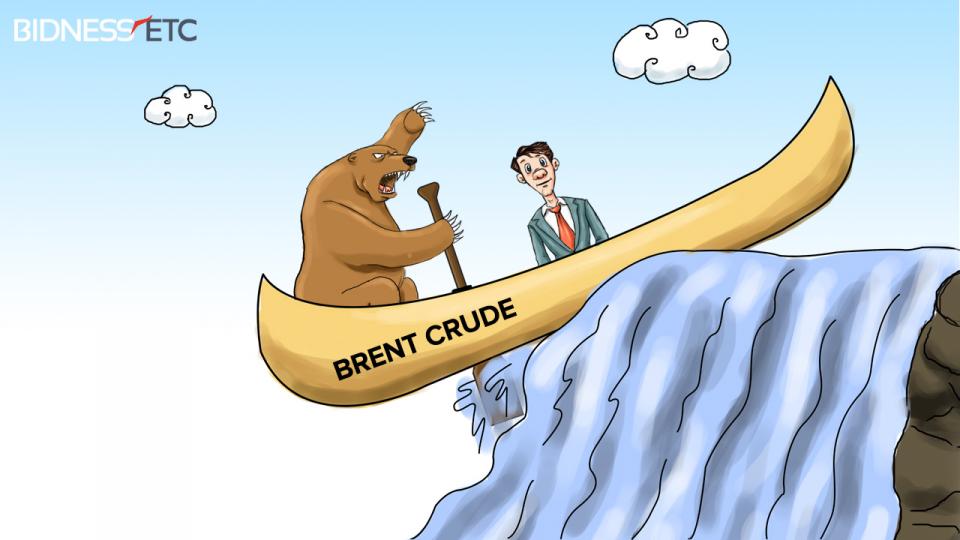

On Friday, both benchmark Brent crude and WTI were trading below 40 dollars a barrel as the supply of oil, which has outpaced demand, continued.

“Storage levels may provide yet another check on reality”, the IEA said.

In fact the IEA sees China’s overall oil demand to increase by 100,000 barrels per day to an average of 13.0 million barrels per day, driven by demand for more petrol.

Opec warned that its “oil demand forecast for 2016 is subject to considerable uncertainties, depending on the pace of economic growth, development of oil prices, and weather conditions, as well as the impact of substitution and energy policy changes”. USA oil last settled this low in February 2009 and Brent in December 2008.

While Novak did not take part in that OPEC meeting in Vienna, Russia is expected to take part in the next expert-level meeting between OPEC and some non-OPEC producers on global oil markets on Tuesday.

“Too much oil is being produced at the moment”, analysts at Commerzbank AG led by Eugen Weinberg in Frankfurt said in a report.

In its monthly report, the IEA said world oil-demand growth will slow to 1.2 million barrels a day in 2016 after surging to 1.8 million barrels a day this year, as support from sharply falling oil prices begins to fade.

“This downward trend should accelerate in coming months, given various factors, mainly low oil prices and lower drilling activities, ” Opec said.

Brent, against which most of the world’s oil, including Nigeria’s is priced, has fallen by more than 60 per cent in the past 18 months, putting pressure on oil-exporting countries.

“Lower prices are clearly taking a toll on non-OPEC supply, with annual growth shrinking below 0.3 mb/d in November from 2.2 mb/d at the start of the year”, the IEA said. Data also showed Opec pumped 31.7mn bpd in November, more oil than any month since late 2008. Iraq, though, increased production by 248, 000 barrels per day in November, representing a spike of 247.5% from its level in October.

With just three weeks left in the year, the state of the oil market is unlikely to improve. That could be a bad sign for oil demand in the world’s second-largest oil consumer, according to Dimitry Dayen, senior research analyst at ClearBridge Investments. “This could automatically have a negative effect on dollar denominated oil prices”, said Hans van Cleef, senior energy economist at ABN Amro.