Disney tops 3Q profit forecasts

Disney’s Media Networks, which operates ABC, ESPN and Disney cable networks, reported a 5% revenue gain to $5.8 billion as on-demand distribution and affiliate revenues grew. Earnings at cable networks rose 7 percent to $2.08 billion.

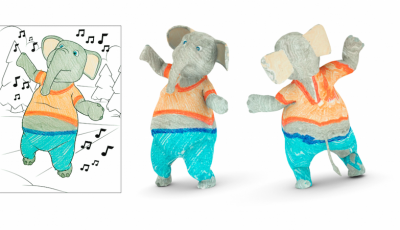

Consumer Products increased its revenues by 6% to $954 million, with a 27% increase in operating income to $348 million.

The record attendance at the Disneyland Resort and at Walt Disney World carried Disney’s Parks and Resorts division – which also includes its cruise lines, vacation resorts and global parks – to its highest quarter ever in revenue and in operating income, Staggs said. Discovery Communications fell to 12% when owners of Animal Planet and Discovery Channel accused them for lower advertising sales as well as a strong dollar for reduced quarterly earnings showing to be below the estimates of analysts. The company’s strengths can be seen in multiple areas, such as its growth in earnings per share, increase in net income, revenue growth, notable return on equity and solid stock price performance.

In other words, if ESPN is losing subscribers, it’s more likely due to American households dropping cable TV services altogether than opting out of ESPN specifically.

The company’s cable network, ESPN is fighting with a decreasingsubscriber base and increasing costs for programs.

But when the company posted mixed second quarter results on Tuesday, the focus was on ESPN, which is being pinched by changes in consumer habits.

Near 1645 GMT, shares of the media and entertainment giant were off 9.0 per cent at US$110.68 after closing at a 52-week high on Tuesday.

The media company now expects annual operating income growth at the unit in the mid-single digits for fiscal years 2013 to 2016, chief financial officer Christine McCarthy said on a conference call. Shares were down 6.32% at $114.00 at 10:19 GMT in pre-market trading on Wednesday. And Disney reported free cash flow of $4.52 billion, compared to $4.43 billion in the same quarter of a year ago. “Short-term downside support for the stock on a continued pullback after this earnings release is around the $US113.00 level, with an upside target at $US125.00”.