Dixons Carphone Profit Beats Forecast in First Year Since Merger

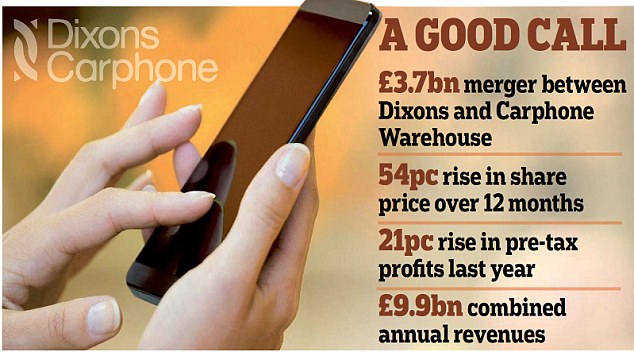

Though investors initially reacted coolly to the plan to merge Dixons Retail and Carphone Warehouse they were quickly won over and the merged group’s share price has risen by almost half since the deal was completed nearly a year ago.

Dixons Carphone Plc (LON:DC) today released its maiden full-year results since its formation last year, which showed that the retailer had enjoyed a strong first year as an enlarged group.

In the United Kingdom and Ireland, revenues rose by 7% to £6.45bn, and earnings before interest and tax grew by 26% to £306m.

‘This has been a terrific first year for Dixons Carphone.

The United Kingdom electrical and telecommunications equipment retailer reported an adjusted pretax profit of GBP381 million for the 13 months ended May 2, in line with its June guidance that profit would be “slightly above” its previous prediction of GBP355 million to GBP375 million.

Earlier this week, James said that fears of a the Greek banking system’s collapse appeared to be encouraging consumer spending in the country, especially on big-ticket items.

D espite recent concerns that its Greek arm Kotsovolos would be impacted by the bailout crisis in the country, Dixons said strong sales of large screen TVs helped boosted like-for-like sales and saw the business return to profit in the year. “We have seen excellent increases in both sales and profitability and we have made very encouraging progress with the tricky job of integrating these two great companies”, James added. The company’s business in Spain, where 55 stores were closed during the year, “continues to operate in a tough marketplace”, according to the results.

Dixons Carphone is building a Connected World Services business with a focus on internet-enabled products that will play a part in the Internet of Things.

“I am acutely aware that there is no room for complacency in a sector which has seen unprecedented change, bringing both opportunities and challenges”, he said.