Dollar falls below ¥110 in Tokyo on cautious Fed minutes

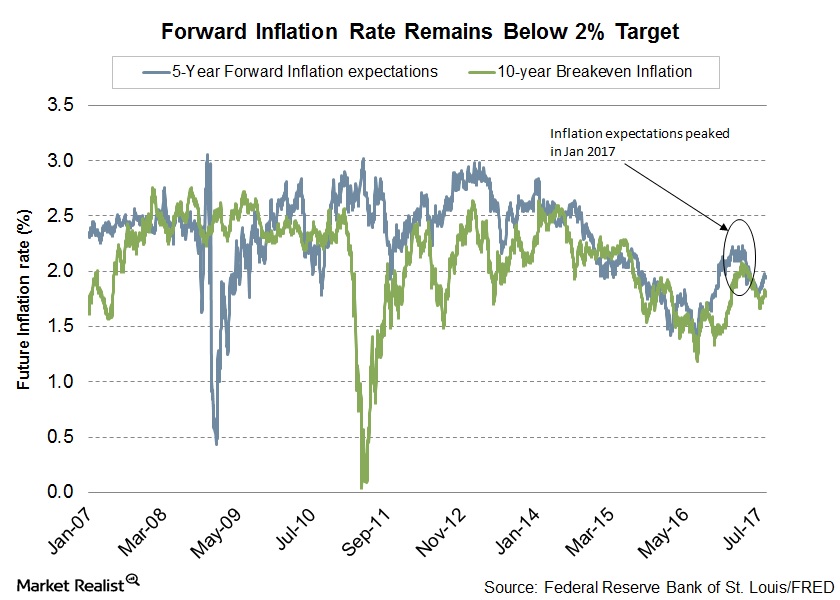

The dollar edged lower on Thursday triggered by the Federal Reserve’s concern over the recent soft inflation, where some suggested of holding off interest rate hikes until they can confirm that the event was only temporary.

“That throws a little bit more doubt into the president’s abilities to push his policies through”, said David Schiegoleit, managing director of investments at U.S. Bank Private Wealth Management in Newport Beach, California.

“But markets think there´s risk to the scenario of a rate hike in December”, said Shunsuke Yamada, chief Japan FX strategist at Bank of America Merrill Lynch.

However, others “saw some likelihood that inflation might remain below two percent for longer than they now expected”, the minutes said.

While the recent geopolitical tensions between the U.S. and North Korea have calmed down, the United States is not having a break from a turbulent political scene, this time internal.

“We’ve gone from the last meeting where there were a few members anxious about inflation undershooting 2 percent for a while, and that group is now many”, said Richard Franulovich, senior currency strategist at Westpac Banking Corporation.

In 3.24pm trading in NY, the Dow Jones Industrial Average rose 0.15 percent, wile the Nasdaq Composite Index added 0.17 percent.

US crude CLcv1 fell 1.6 percent to $46.79 per barrel and Brent LCOcv1 was last at $50.33, down 0.93 percent on the day.

– The Stoxx Europe 600 index added 0.7 percent to 379.09, the highest in a week. A 2.1 percent annual increase in February was the only month since 2012 the index’s annual increase exceeded the Fed’s target.

Commodities, that are priced in US dollars, also benefited from the weakness in the currency.

Benchmark 10-year notes US10YT=RR last rose 11/32 in price to yield 2.229 percent, from 2.266 percent late on Tuesday.

At 9:43 a.m. ET (1343 GMT), the Dow Jones Industrial Average was down 63.63 points, or 0.29 percent, at 21,961.24 and the S&P 500 was down 5.06 points, or 0.21 percent, at 2,463.05. If the precious metal could break above $1,300, it is on track to a retest of the $1,375-high it reached in 2016.

On commodities markets, crude prices bounced back following a sharp decline overnight even though inventory data from the Energy Information Administration showed another massive drawdown last week.

Gold futures rallied Thursday amid renewed concerns that President Donald Trump’s pro-growth economic agenda will be derailed by political turmoil.

Spot gold fell 0.8 percent at $1,271.58 an ounce while US gold futures for December delivery dropped 0.8 percent at $1,279.70.