Donald Trump’s Tax Plan Could Balloon The Debt By 75 Percent

Getting that money back into the U.S.is considered the cheapest form of stimulus. How many trillions is unknown, they said, because of Trump’s lack of detail on which tax breaks he would wipe out.

Actually, the plan’s effects on the debt would be even worse than that.

Here’s a closer look at what the candidates are selling. It goes further than one has to on rate reduction on the corporate level.

In case you’re curious, here are the top tax rates on the rich from each of the leading candidates. He also wants to eliminate the so-called carried interest loophole that allows managers of hedge funds and private equity firms to pay a lower tax rate than most individuals.

Several popular deductions, for home mortgage interest and medical expenses, would be capped, and filers would no longer be able to deduct state and local taxes. “They have to pay taxes”.

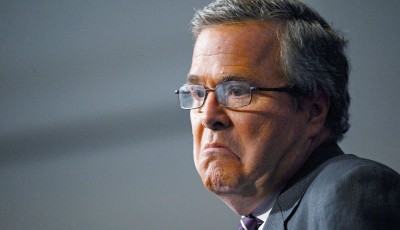

Jeb Bush and other Republicans have also blasted Trump’s tax plan calling it unrealistic. On the other hand, tax breaks focused on low-income earners have an outsized impact for the inverse reason.

The New York billionaire would reduce the number of tax brackets from seven to four, with a top rate of 25%.

Here’s a video of Patriotic Millionaires describing the “craziness” of the carried interest tax loophole. The end result, however, is that the extremely wealthy would likely end up paying less.

The Congressional Budget Office projects this fiscal year’s federal deficit will be $426 billion, meaning Trump would need to find that much in potential spending cuts if his tax plan was revenue-neutral in order to balance the budget.

A few in the middle class will benefit from the elimination of the Alternative Minimum Tax.

However, numerous families in this bracket already pay no federal tax. Such reductions might change the overall cost of the plan, or the specific impact on an individual like Trump. For households in the bottom quintile, inflation-adjusted after-tax income grew a healthy 48%. Trump’s plan would fall an estimated $10,140,000,000,000 short of that goal. “Ours would eliminate all of that, and you can file your tax return on one single postcard”. Americans with average earnings of $148,100 (the 80 to 95 percent) would see savings of $7,500, or 21 percent of Trump’s tax cut. “People without kids will get a tax cut”.

Experts are pouring over the details, trying to figure out what his version of simplifying the tax code would mean.

Trump – who leads his 14 rivals for the 2016 GOP nomination, including New Jersey Gov. Chris Christie – said in interviews this summer that his plan would hike taxes on the riches Americans.

He’d do away with other corporate, personal, payroll, excise and estate taxes entirely and exempt the first $50,000 of all earned income. Grover Norquist, the anti-tax-increase crusader at Americans for Tax Reform, was pleasantly surprised by the plan.

Roberton Williams, a senior tax expert at the Tax Policy Center, said that Trump’s plan was hard to implement.

It would also forbid US corporations from deferring taxes on income earned abroad, providing them a one-time tax holiday rate of 10 percent – instead of the current 35 percent – on the more than $2 trillion parked overseas now. Don’t they have plans, too? “In fact, there is no possibility that this plan would not be a huge tax cut for the rich and a big revenue loser for the government”. Under Trump’s plan, it would be taxed as ordinary income at the new top rate of 25 percent, down from 39.6 percent.

Retired neurosurgeon Ben Carson has repeatedly asserted that a progressive income tax structure – which, by the way, the U.S. has used for over 100 years – is socialism.

The Trump campaign rhetoric, said Strain, has been that the top 1 percent of earners and Wall Street wouldn’t like the plan and that it would “scratch the populist itch” to take care of middle-income earners.