Dow falls more than 300 points

Biotech stocks had their worst week since 2008 last week, as stocks like Gilead Sciences (GILD), Amgen (AMGN), Biogen (BIIB) and Regeneron (REGN) got hammered following Hillary Clinton’s drug-pricing tweet.

The fear-gauge CBOE Volatility Index (VIX) rose 0.6% to settle at 23.62. The recent price brings its past 5-day performance at -27.16 percent and trades at an average volume of 949.57K shares. For 51% stocks that declined, 46% advanced. Stocks slid on Monday as global equities tumbled amid a rout in commodity and biotechnology shares.

Josh Brown, CEO and co-founder of Ritholtz Wealth Management, pointed to biotech, as the iShares Biotech ETF (IBB) has fallen almost 20% over the past two weeks. The Nasdaq Biotechnology Index fell into a bear market amid its worst weekly decline in four years. The SPDR S&P Health-Care Services ETF slipped 2.8 percent, extending its two-day loss to 4.5 percent. This was reinforced by comments by New York Fed President William Dudley, who told the Wall Street Journal that rates will go up this year. Late Thursday, Yellen indicated that the lift-off option is very much on the table later this year.

“All of this data will be parsed for signs that the five-year-old slowdown in China is impacting the US economy“, John Canally, investment strategist and economist at LPL Financial, said in a recent note. The labor market has recovered faster than in past recessions, but wages have not increased as quickly as most would have hoped.

After the Fed decided earlier this month not to raise rates, the stock market reacted negatively. It is speculated that Yellen’s speech reduced the concerns to some extent, which in turn boosted investor sentiment. (JPM – Analyst Report) and Citigroup Inc. And, the S&P 500 rallied during the shutdown of 2013. He said he expected growth in the second half will be “a little bit weaker” than in the first half. According to “third estimate” released by the U.S. Department of Commerce reported on Friday, the economy grew at a pace of 3.9%, higher than the consensus estimate and previously projected growth of 3.7%.

USA companies reporting quarterly earnings on Tuesday include Costco and Diamond Foods. Nike contributed around 68 points in the Dow’s gains on Friday. What was once the best-performing sector in the S&P 500 is seeing those gains rapidly evaporate, led by a severe repudiation of biotechnology stocks and exchange traded funds. Investors were also concerned about the high levels of debt the company’s trading arm needs. However, the reading was below August’s final reading of 91.9.

In London, FTSE100 was trading up 141 points at 6,104, while in France and Germany, shares were also higher. A whirlwind of mergers and acquisitions, promising industry fundamentals, plenty of drug launches, growing demand in emerging markets, ever-increasing healthcare spending and Obama care play major roles in making it a lucrative bet for the long term (read: Obamacare is Here to Stay: 3 ETFs to Buy ). Britain’s FTSE 100 was up 1.9 percent. West Texas Intermediate crude futures in New York dropped below $45, down more than 2% near $44.59.

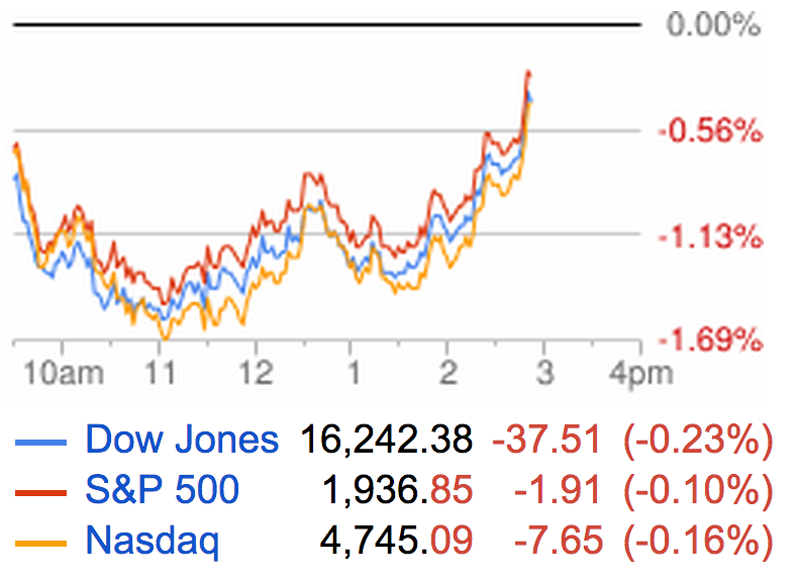

The Dow remains more than 10% off its peak from May, while the S&P 500 is 9.5% off its May high.