Dubai market loses 7% after oil price dip

Prices of crude have collapsed by close to 62 percent since the November high of close to $105 last November which is being seen as a huge negative for oil producing countries in the Middle East.

The strategy effectively triggered a price war with shale drillers in the US and Russian Federation .

The Saudi market was the region’s top performer this year ahead of its opening to foreign investors in June, but it is now down more than 10% in 2015 so far.

Sunday was the primary day of buying and selling within the Center East after Brent crude, a benchmark for worldwide oil, fell greater than a greenback to shut Friday at $45.46 whereas the worth of U.S. crude closed at $40.45. “Markets in the Gulf are changing their expectations and looking at the possibility of different conditions in future: lower oil prices, perhaps lower government spending”, said Adel Merheb, director of equity capital markets at Dubai’s Shuaa Capital. Maintenance of oil output has secured market share and proved devastating for US onshore drilling.

The meeting ended in acrimony with none of the participants particularly happy about the outcome – except, that is, Mr Naimi.

Expectations of excessive supply from the OPEC countries, led by Saudi Arabia, has also been keeping oil prices down. “The Saudi economy still enjoys sound fundamentals, in view of its financial reserves, coupled with the newly appointed young decision-makers at the leadership level who come from the business community”, Al-Ghalayini said.

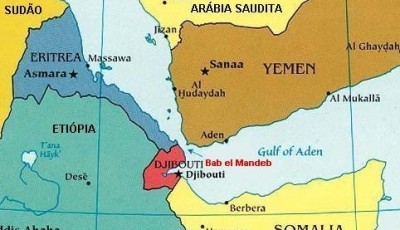

This bodes especially worse with Saudi Arabia, which has prospered in the area despite the unruly climatic conditions of the area.

Falling oil prices add to the chances of deflation, of course, but consumers do not tend to hold off filling up their tanks because they think petrol will be cheaper next week. Iran wants to increase output by about 1m bpd to 4m bpd in the next year or two.

“The Saudi government can’t continue to be the employer of first resort, it can’t continue to drive economic growth through big infrastructure projects”, said Farouk Soussa, chief Middle East economist for Citigroup Inc.in London.

Saudi Aramco is considering whether to build a new industrial city in the south of the al-Ahsa district in Saudia Arabia’s Eastern Province, as authorities seek to expand the kingdom’s base, industry sources said.