DuPont CEO Set To Exit This Month

That triumph, whereas slender, was in fact common just like a realize due to the results of Mr. Peltz along with other activists lately with their makes to effectively change around the manager collection. DuPont’s research strength was a key component of Kullman’s argument against Peltz’s carve-up plan.

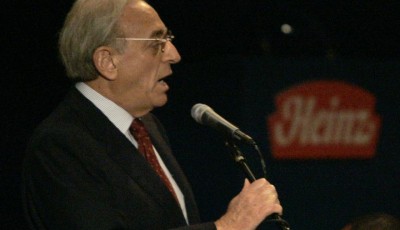

She also won a proxy fight in May with activist investor Trian Fund Management LP and its founder Nelson Peltz. Breen is now a member of the company’s board of directors.

CEOs usually loathe to breakup the companies over which they preside, and it’s not like DuPont has completely eschewed the shrink-to-grow strategy that’s now in fashion.

Kullman, 59, joined the company more than 27 years ago and has been its CEO since 2009.

Another crummy quarter sure wasn’t going to help her cause.

Cut earnings According to the company statement, DuPont now expects operating earnings per share for the full year to be approximately $2.75, compared with the prior guidance of $3.10. The company said the revision primarily reflects the effects of a stronger dollar against emerging-market currencies, especially the Brazilian real, and the further weakening of agricultural markets, again primarily in Brazil.

“Typically a new CEO is chosen before a sitting CEO steps aside, so this could be a sign Kullman was asked to leave”, said Pat Cook, head of Cook & Co, a Bronxville, New York-based executive-search firm. DuPont didn’t release details Monday on how it would achieve those cuts, saying plans are to be finalized in the fourth quarter.

A source close to DuPont told Reuters that Breen has said that DuPont’s four main divisions have synergies and that he did not want the CEO job permanently.

Going all-in on the shrink-to-grow playbook is the best chance Dupont stock has to get back to generating at least OK returns.

In after hours trade on Monday, the stock was up as much as 6%.

As of this writing, Dan Burrows did not hold a position in any of the aforementioned securities.