Economy seen to meet target on services, realty

Where does China go from here? For greater accomplishments, the US role will be to determine the price of status, and the Chinese role will be to determine whether that price is worth paying. This expectation is based on a conditional convergence framework that relies on data generated by China’s unique growth experience, as well as those of other economies, over the last three decades. Small wonder the recent bobbling in Beijing’s economy has caught the armed services’ attention. Other Western consumer companies, though, flagged in their second-quarter earnings that China was turning into a tough market, before most of the recent equity market turbulence. Our two economies and educational systems are deeply intertwined. He wrote that they had already achieved most of their potential, and for Singapore, he wondered only how fast it would fall.

“The barriers China is throwing up are becoming more serious”, particularly in areas of advanced technology, said Yukon Huang, a senior associate at the Carnegie Endowment for global Peace in Washington. “India is a large economy, but for now, its major competitors do not include China, but economies like Vietnam and the Philippines, which are eager for investments and infrastructure development, many of which are from China”.

Such efforts to increase productivity are all the more important as China moves to shift from investment- and export-led growth to a more sustainable model based on domestic consumption and services.

Cooperation between China and India could also help to accelerate the growing convergence of interests between the two economies.

In terms of China overall, it was also explained that the country still represents “unmatched opportunities”, but also “unmatched volatility“; the latter being because the sheer physical size and intrinsic nature of Chinese consumerism is changing so quickly.

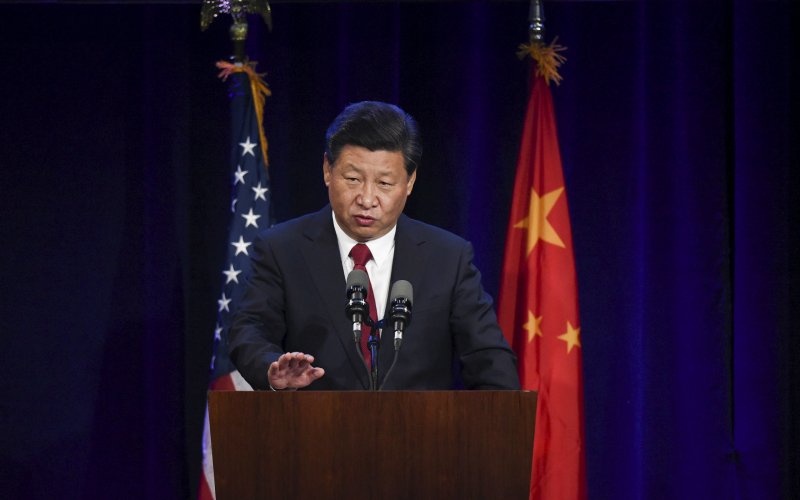

It is only a slight exaggeration to say that China’s economic hopes rest on the faux-Corinthian columns of Global Harbor. Mr. Xi’s first stop in his USA state visit is Seattle, where a host of US tech and business leaders will greet him. The USA military is in marginal condition. For example, a private Chinese firm has bought Smithfield Foods, and the company’s pork exports to China jumped 45 per cent in the first half of 2015.

[READ: China’s Xi Jinping Flexes Business, Tech Muscle].

Pundits love debating the Chinese economy’s growth prospects, and nowadays the pessimists are gaining the upper hand. The tables have since turned.

In this special edition China Briefing Industry Report, we cast our gaze over the broad landscape of China’s entertainment industry, identifying where the greatest opportunities are to be found and why. But for years China has been one of the biggest buyers of U.S. Treasury bonds, and more recently Chinese investors have been gobbling up American houses and other real estate, particularly on the West Coast.

He expressed confidence, despite a feeble recovery in the global economy and turbulent global markets.

But Premier Li Keqiang had said China had many policy tools to manage its slowing economy.

On Monday, the Chinese Academy of Social Sciences, a top academic research organization, cut China’s growth forecast for this year from 7 percent to 6.9 percent. One thing is clear, however: Its days of double-digit growth are long gone. What is missing are policies to better enable direct investment and to provide companies a level playing field.

Still, China’s monetary policy bears watching, as do the underlying fundamentals of the economy-especially the services sector, which is now larger than the country’s manufacturing and construction sectors combined. The photo ops and video footage beamed back to China will bolster Xi’s status by association. It was pointed out that China’s population moving into middle class consumerism will not just disappear, meaning that it is nearly an inevitability that this development will proceed.

The summit’s economic agenda will include familiar issues of importance to America’s interests such as currency and protection of intellectual property.

Reports from the Shanghai chamber and other groups indicate that USA companies largely are still doing well in China. Early estimates for China’s cement production in 2014 suggest consumption of 2.5 billion tonnes of cement each year, according to USGS figures, which is growth of around 3.3%. But that’s down from 65% in 2010, and their profit margins are getting squeezed, said the council’s president, John Frisbie. His administration has continued and expanded the annual high-level strategic dialogue first established under President George W. Bush, as well much longer-running joint talks focused on trade.

China’s path, however, is not free from hindrances.

Beijing has only said that it is targeting growth this year of around 7 percent. Really? Does anyone in the world truly believe that the Chinese leaders are clueless?